Shares of the apparel and accessories provider Guess?, Inc. (NYSE:GES) have risen by double digits today after delivering better-than-expected numbers on both the top and bottom line fronts. Revenue rose 3.4% year-over-year to $665 million, comfortably cruising past expectations by $24.5 million. Furthermore, EPS at $0.72 also handily outperformed estimates by $0.32.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, revenue across Europe and Asia rose by 9% and 19%, respectively, on the back of gains in eCommerce and comparable retail sales. However, revenue in the Americas retail and Americas wholesale verticals dropped by 8% and 13%, respectively.

GES is experiencing better customer conversions at its stores and robust momentum in its global brands. For the full year 2024, the company expects net revenue to increase in the range of 2.5% and 4%, with anticipated EPS between $2.88 and $3.08.

Furthermore, for the third quarter, the company expects net revenue to grow in the range of 2.5% to 4.5%, with projected EPS between $0.55 and $0.64. Additionally, GES has announced a quarterly dividend of $0.30 per share. The dividend is payable on September 22 to investors of record on September 6.

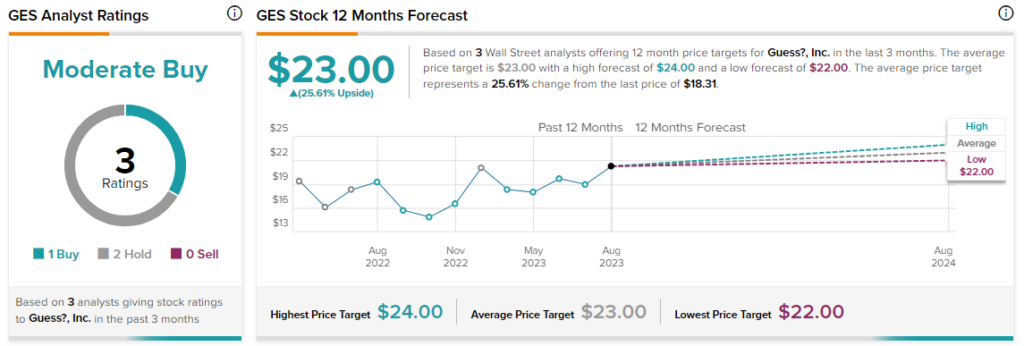

Overall, the Street has a consensus price target of $23 on GES, along with a Moderate Buy consensus rating. Short interest in the stock is currently hovering at 28.8%.

Read full Disclosure