Nvidia (NASDAQ:NVDA) is down just over 3% in Wednesday afternoon’s trading. The problem is that no one is quite sure why. A flood of positive analyst sentiment recently poured out around the stock, but it’s having pretty much the exact opposite impact than should be the case. So what’s going on under the hood that’s got investors so anxious?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

One of the biggest cheerleaders Nvidia found today was Vivek Arya, an analyst with Bank of America. Arya had little shortage of praise for Nvidia, believing that Nvidia is still only in the first quarter or so of its ability to upgrade the computing infrastructure landscape to accommodate artificial intelligence. In fact, Arya upgraded his price target from $650 to $700 per share as a result of the latest information and figures. The closest thing he had to a negative was that there could be some “…near-term churn…” to face down at Nvidia, and that there might be some losses in the Chinese market as a result of export curbs, but these were comparatively minor issues. Other analysts like Citi’s Atif Malik joined in, with Malik pointing out that the upcoming Consumer Electronics Show would feature a “special address” from Nvidia that would, in turn, likely offer a “major catalyst.”

The Bans Keep on Coming

All of this should be good news for Nvidia, and investors should be happier. But it’s hard to be happy when one of your biggest customers, China, keeps losing the ability to buy things from you. Recently, the U.S government shuttered sales of Nvidia’s fastest gaming graphics processor, the RTX 4090. That’s going to be a blow to Chinese gamers, and considering that the Chinese government once put a lot of restrictions on video games in China, you know that it’s a serious market. It’s easy to wonder where the whole thing will actually end, and if Nvidia will even be able to sell processors worthy of the name into one of the planet’s biggest markets.

Is Nvidia a Good Buy Right Now?

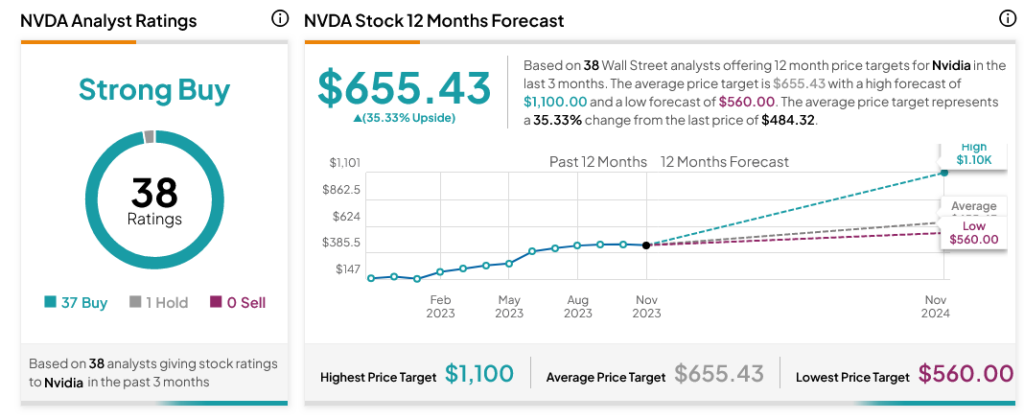

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 37 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 192.63% rally in its share price over the past year, the average NVDA price target of $655.43 per share implies 35.33% upside potential.