Shares of e-commerce marketplace Groupon (NASDAQ:GRPN) were up 5% in Tuesday’s pre-market trading after a Securities and Exchange Commission (SEC) filing revealed that the company’s key insider and an owner of more than 10% GRPN stock, interim CEO Dusan Senkypl, increased his stake in the company through the purchase of additional shares.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Details of the Insider’s Trade

As per the SEC filing, Senkypl, who serves as Groupon’s interim CEO and director of the board, along with another director and more than 10% owner Jan Barta and Pale Fire Capital SICAV (an entity affiliated with Senkypl), purchased 323,344 shares from November 16 to November 20, for an aggregate value of $3.07 million.

It is worth noting that the insiders made this transaction pursuant to the recently announced $80 million fully backstopped rights offering, under which the aforementioned parties agreed to fully purchase any unsubscribed shares following the expiration date. The company said that it intends to use the proceeds from this rights offering for general corporate purposes, including possible repayment of debt.

As per TipRanks, following the above transaction, Senkypl owns 7.49 million shares worth $71.4 million.

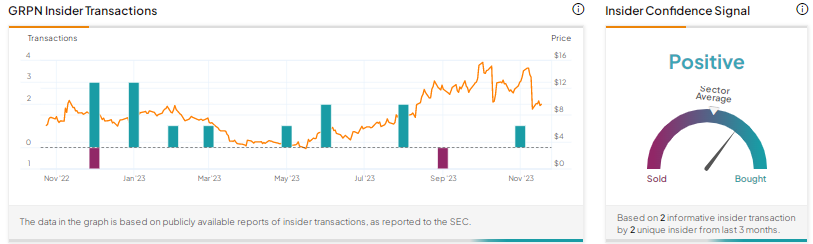

As per TipRanks’ Insider Trading Activity Tool, the Insider Confidence Signal for Groupon is Positive. Corporate insiders have made Informative Buys of GRPN shares worth $5.7 million in the last three months.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is GRPN Stock a Buy, Sell, or Hold?

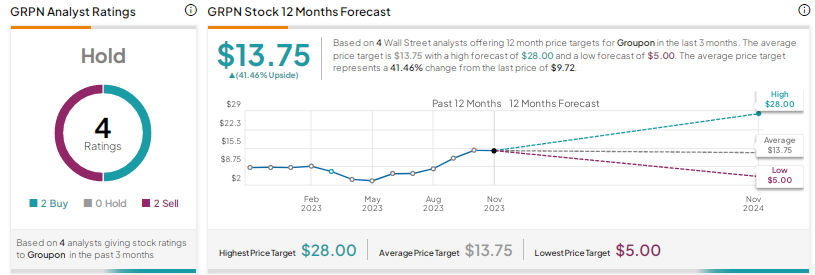

Groupon recently reported dismal Q3 2023 results. Wall Street is sidelined on the stock, with a Hold consensus rating based on two Buys and two Sells. The average price target of $13.75 implies 41.5% upside potential. Shares have risen 13.3% year-to-date.