While Groupon (NASDAQ:GRPN) offers no shortage of coupons on everything from exciting experiences to useful household goods, it’s not offering much value for investors today. In fact, Groupon is down over 31% in Tuesday’s trading thanks to a new plan to sell off some investments at less than full value.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The plan in question involves Groupon selling shares equivalent to roughly 9.4% of the 2.3% stake that it holds in SumUp Holdings to other SumUp investors. The surprisingly complex measure works out to a very simple cash value of 8.4 million euros, or around $8.9 million. Groupon is joining several other SumUp investors who have agreed to sell shares on similar terms. However, Groupon investors aren’t happy about this move, as some think that Groupon should have held out for more money and that the shares are being sold below fair value.

Groupon, for its part, noted that the sale is being done for two key reasons: one, to raise cash, and two, as part of an ongoing program to “monetize certain non-core assets,” likely as a means to better focus on its primary operations. Interestingly, this news comes about two weeks after reports that Windward Management is buying in big on Groupon, suggesting that, by this time next year, Groupon will be worth five times more than what it is now. While certainly, the demand for discounts will likely be big, considering current conditions, they may not be big enough to overcome inflation and further economic slumps.

Is Groupon Stock a Good Buy Now?

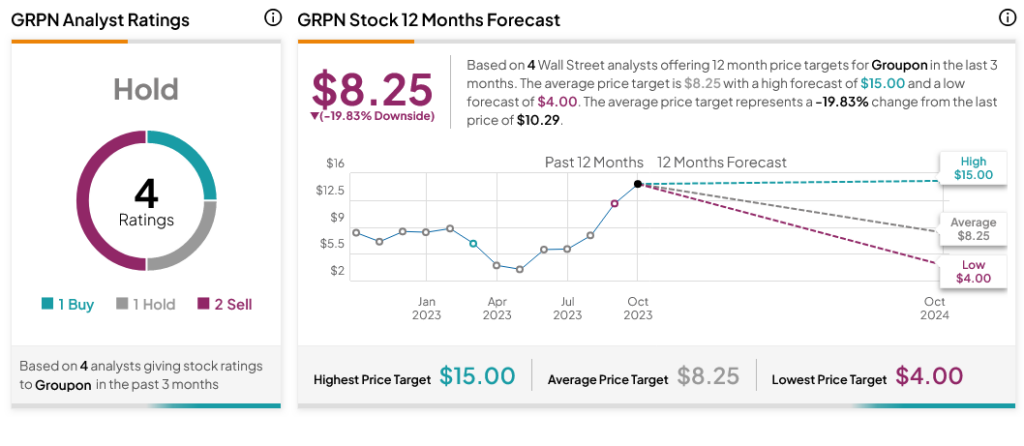

Currently, analysts are skeptical about Groupon’s future success. With one Buy rating, one Hold, and two Sells, Groupon stock currently rates as a Hold by analyst consensus. Further, the average GRPN price target of $8.25 implies 19.83% downside risk.