GreenPower Motor (GP) (TSE: GPV) recently announced plans to acquire Lion Truck Body, which designs and installs truck bodies for a wide range of industries. Some examples of the truck bodies it offers include aluminum beds, dry-freight aluminum, refrigerated box, flatbed, and service body.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For a price tag of $1.69 million, GreenPower will add $3.5 million in revenue. The purchase is broken up into three parts. First, GreenPower will pay $215,000 upfront in cash. Secondly, it will assume $1.45 million in liabilities, and lastly, up to an additional $25,000 will be paid out based on post-closing conditions.

The rationale behind the acquisition is that it will allow the company to reduce delivery times. Indeed, Brendan Riley, president of GreenPower, claims that it will cut down the time from months to weeks. The acquisition appears to be a good fit for the company since both were already working together.

Retail Investors on TipRanks Have Been Selling GreenPower

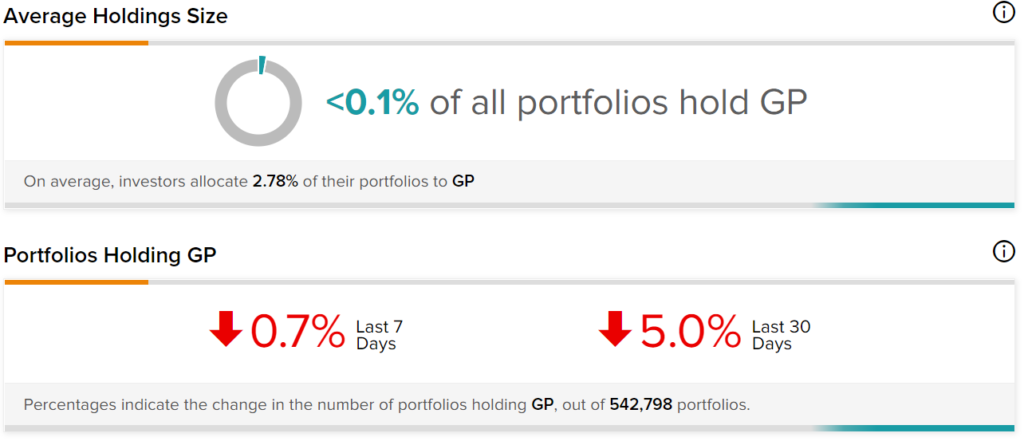

Out of the 542,798 portfolios tracked by TipRanks, less than 0.1% hold GreenPower. However, the average portfolio weighting allocated towards GP among those who do have a position is 2.78%. This suggests that investors of the company don’t have much confidence.

Furthermore, there have been some portfolio changes in the last 30 days, as 5% of those holding the stock decreased their positions. When looking at the past seven days, 0.7% of investors decreased their holdings.

What Do Analysts Think of GreenPower?

Five-star analyst Tate Sullivan from Maxim Group is the only analyst who has issued a price target in the past three months, and he remains bullish, as he has reiterated his Buy rating on GreenPower. Indeed, he has issued a price target of $9 per share. At the current price, this represents upside potential of 166%.

Final Thoughts – A Solid Acquisition

GreenPower appears to have made a smart acquisition that will improve its operations. In addition, the price paid seems very reasonable and consists mostly of assumed liabilities, which means it won’t have to put up too much cash upfront.