Shares of electric vehicle maker GreenPower Motor (NASDAQ:GP) are up in double digits today after its fourth-quarter revenue soared 255% year-over-year to $15.3 million.

The company delivered 123 vehicles during the quarter. A major part of these deliveries was made up of EV Star cab and chassis, EV Star cargoes, EV Stars and Nano BEAST Type A buses. Along with this top-line growth, GreenPower also managed to lower its selling, general, and administrative expenses as a percentage of revenue to 36% from 133% in the year-ago period. Net loss per share at $0.16 though came in wider than estimates by about $0.04.

Impressively, while GreenPower’s commercial vehicle group currently has 42 active orders alongside 141 purchase orders, its school bus group has 63 active orders.

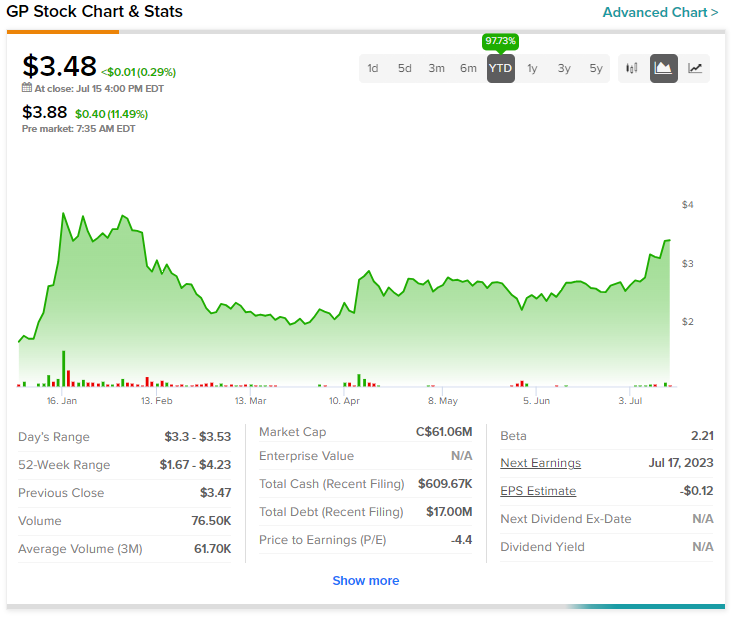

Today’s price gains come on top of a nearly 98% jump in GreenPower shares year-to-date. B. Riley’s Christopher Souther, the lone analyst tracking GreenPower, has reiterated a Buy rating on the stock alongside a $5 price target. This points to a further 43.7% potential upside in GreenPower shares.

Read full Disclosure