Shares of Palo Alto Networks (NASDAQ:PANW) gained in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at $1.10, which beat analysts’ consensus estimate of $0.94 per share. Sales increased by 23.7% year-over-year, with revenue hitting $1.7 billion. This was mostly in line with analyst expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Palo Alto Networks management also provided future projections for the fourth quarter. Revenue is expected between $1.937 billion and $1.967 billion against analyst consensus of $1.95 billion. Meanwhile, earnings per share are expected between $1.26 to $1.30, against analyst consensus of $1.18.

Further, for the full year 2023, management expects revenue between $6.88 billion and $6.91 billion, while analysts look for $6.9 billion. Meanwhile, earnings per share for the full year are expected between $4.25 and $4.29, against analyst projections of $3.99.

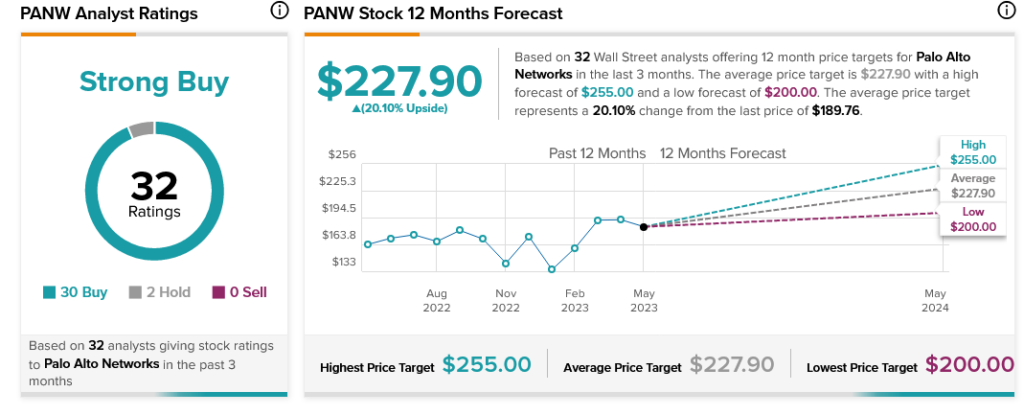

Overall, Wall Street has a consensus price target of $227.90 on Palo Alto Networks stock, implying 20.1% upside potential, as indicated by the graphic above.