Shares of Alphabet (NASDAQ: GOOGL) were down on Wednesday before recovering in pre-market trading on Thursday after the tech giant unveiled some major AI-based updates at its AI event in Paris. The company announced its plans to take on Microsoft’s (MSFT) OpenAI-integrated search engine Bing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

GOOGL intends to do this by enhancing its search results with generative AI and these search results will be in the form of text or visual responses to prompts.

But these AI-related updates have so far proved to be a damp squib as earlier this week, the launch of its AI-enabled chatbot service Bard was not without significant hiccups. This was because the company’s ad of Bard on its official Twitter account showed inaccurate answers.

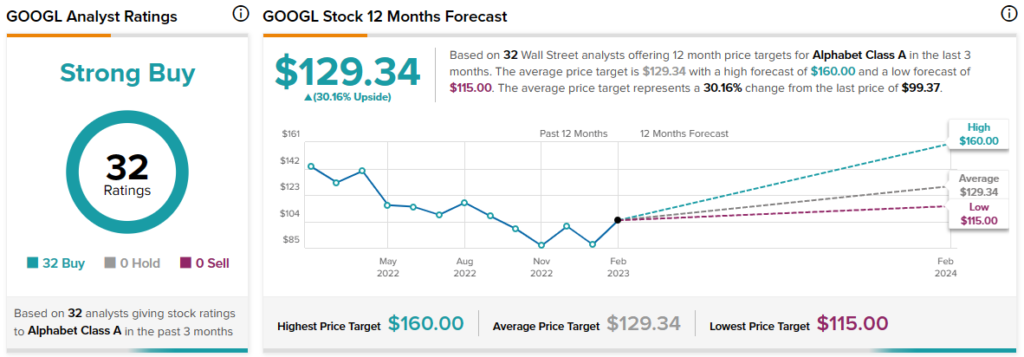

Despite this significant embarrassment for GOOGL, Atlantic Equities analyst James Cordwell reiterated a Buy rating and price target of $115.00 on the stock. The analyst’s price target implies an upside potential of 15.7% at current levels.

Cordwell commented on the Bard launch, “…the launch does intensify competition and potentially impact profitability in the search market, with this development thus more of a negative for Alphabet than it is a positive for Microsoft.” However, the analyst added that this “concern is already reflected in the stock and remain O’weight on both [MSFT and GOOGL] names, with a preference for Alphabet given its greater cyclical skew.”

Overall, while Wall Street seems to be underwhelmed by GOOGL’s AI-related updates, analysts still remain bullish about GOOGL stock with a Strong Buy consensus rating based on unanimous 32 Buys.