Alphabet (GOOGL) (GOOG) reported a strong quarter yesterday, with its Gemini AI assistant reaching 650 million monthly active users. The milestone marks a 44% jump from July, when the company last reported 450 million users. The surge came alongside Alphabet’s quarterly earnings, during which revenue climbed 14% to $96.4 billion, and shares rose nearly 8% in pre-market trading after the report.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AI Adoption Fuels Growth

The rise in Gemini users highlights how fast people are adopting Google’s new AI products. Much of the growth came from a viral image generation feature called Nano Banana, which has created over 5 billion images since its August launch. The feature helped attract millions of new users to the Gemini app in September alone. At the same time, Google’s AI Mode, which adds conversational search features, reached 75 million daily active users across 40 languages.

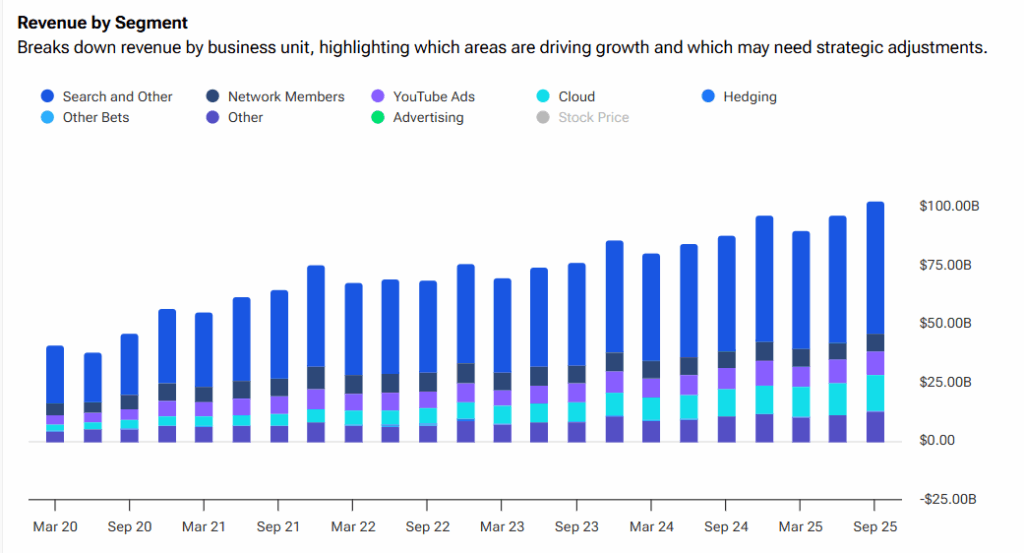

The strong user growth comes at a time when Alphabet’s broader business is also expanding. YouTube advertising revenue increased 13% to $9.8 billion, while Google Cloud revenue jumped 32% to $13.6 billion. Together, these results helped Alphabet post its first-ever $100 billion quarter. Investors reacted quickly, pushing the stock up to $296 in early trading, reflecting growing optimism about the company’s AI-driven strategy.

Competition and Outlook

Although OpenAI’s (PC:OPAIQ) ChatGPT still leads with about 800 million weekly users, Alphabet’s progress shows it is catching up fast. Unlike stand-alone AI platforms, Google benefits from integrating Gemini into its existing products, such as Search, YouTube, and Android. This approach gives the company multiple paths to grow usage and revenue. Additionally, Alphabet plans to launch Gemini 3 later this year, signaling that AI will remain at the center of its growth plans.

Alphabet’s latest numbers show how AI is becoming a key engine for its business. As more users engage with its tools, the company is building momentum that could shape its next phase of growth in both consumer and enterprise markets.

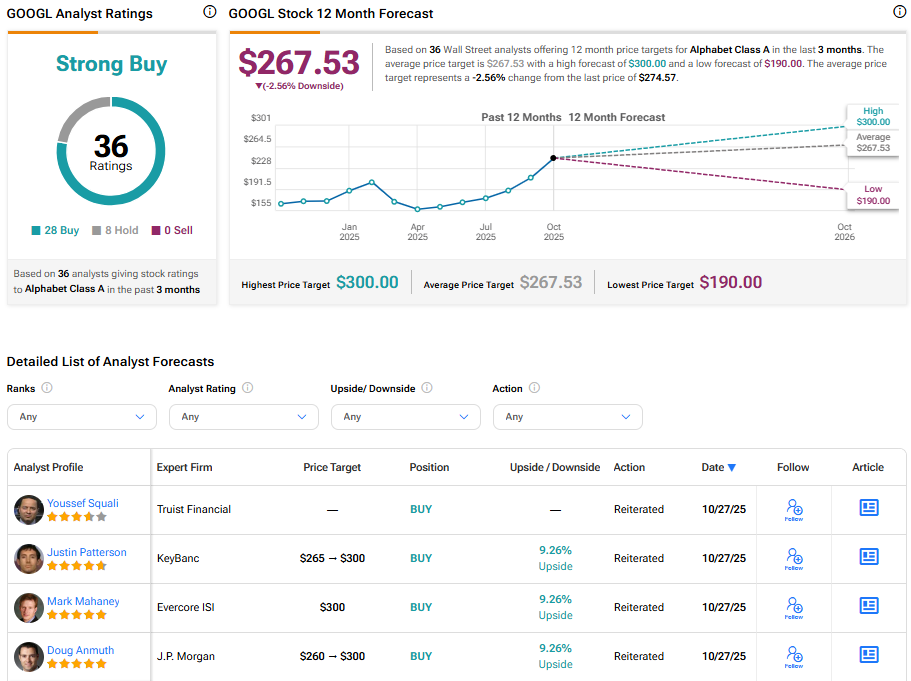

Is Google a Good Stock to Buy?

Google still holds the backing of the Street’s analysts, with a Strong Buy consensus rating. The average GOOGL stock price target stands at $267.53, implying a 2.56% downside from the current price.