Tech giant Google’s (GOOGL) main challenge has so far been how to make money from AI without hurting its core search business. In fact, some feared that AI tools like Gemini and AI Overviews might replace traditional search and reduce ad revenue. However, Google’s strong $100 billion quarter suggests that AI is actually boosting demand for information, not replacing it. Instead of cannibalizing search, Google appears to be expanding its reach with smarter, more engaging tools that keep users on its platform, according to Yahoo Finance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As a result, Alphabet’s stock jumped 5% after the latest earnings report, as Google showed that it can handle massive AI investments while still growing profitably. In addition, analysts praised the company’s innovation and financial performance. For example, Morningstar highlighted Gemini’s success, which now has over 650 million users, while Wedbush noted that the company has moved past its legal issues and now looks well-positioned in the AI race.

In addition, Alphabet raised its full-year capital spending forecast to $93 billion due to strong demand for AI tools. Notably, CFO Anat Ashkenazi said that customers are already asking for more AI services than the company can provide, which is undoubtedly a nice problem to have. Analysts also noted that there is plenty of potential long-term upside from early-stage bets like Waymo and quantum computing.

Is Google Stock a Good Buy?

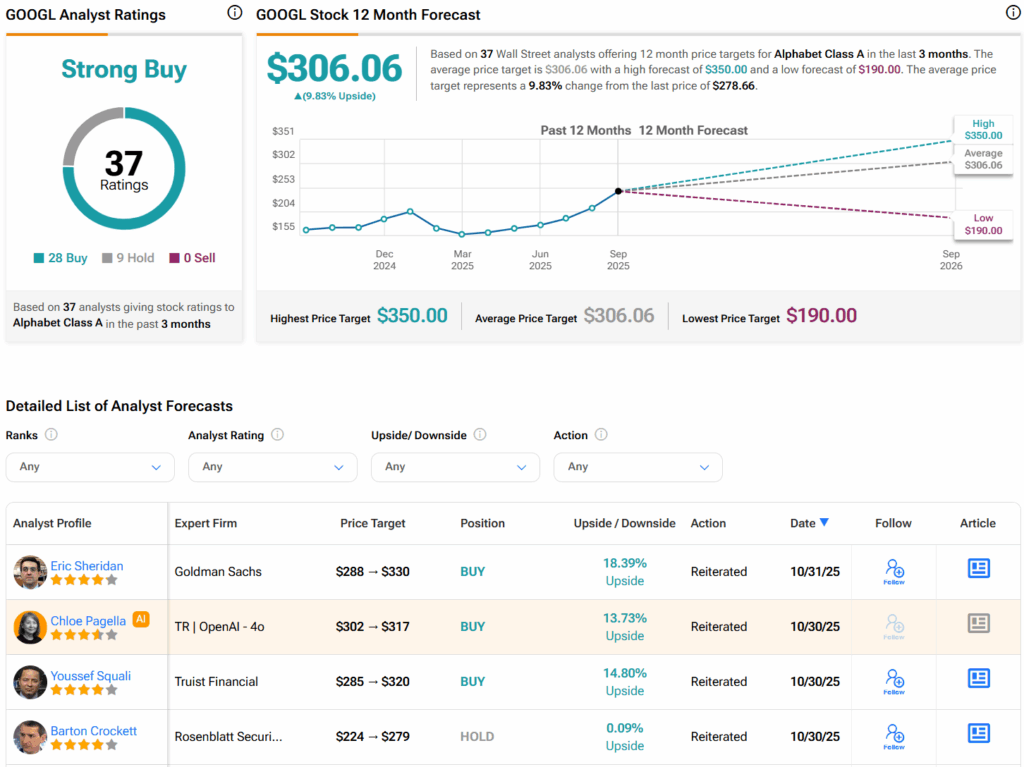

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 28 Buys and nine Holds assigned in the past three months. Furthermore, the average GOOGL price target of $306.06 per share implies 8.2% upside potential.