Nokia has teamed up with Google Cloud to develop 5G core network infrastructure and enable business customers to offer a platform for smart retail, automated manufacturing, and other online consumer experiences.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As part of the partnership, Google (GOOGL) Cloud will provide the platform for communications service providers (CSPs) to modernize their network infrastructures and unlock monetization opportunities by boosting 5G connectivity and providing new online services for consumers. The platform will also ease shifting workloads across public and private clouds.

Meanwhile, Nokia (NOK) will supply its voice core, cloud packet core, network exposure function, data management, signaling, and 5G core. This includes Nokia’s IoT connected device platform, which enables automated, zero-touch activation and allows for remote management of IoT devices. Nokia’s converged charging tool, which provides real-time rating and charging capabilities will also be part of the infrastructure.

“In the past five years, the telecom industry has evolved from physical appliances to virtual network functions and now cloud-native solutions,” Ron Haberman, CTO of Cloud and Network Services at Nokia, said. “Nokia is excited to work with Google Cloud in service of our customers, both CSPs and enterprise, to provide choice and freedom to run workloads on premise and in the public cloud. Cloud-native network functions and automation will enable new agility and use-cases in the 5G era.”

With the use of cloud-native applications, businesses can benefit from lower latency and reduce the need for costly, on-site infrastructure, allowing them to transform their businesses in industries such as smart retail, and automated manufacturing and digital consumer experiences.

The collaboration comes as Google is joining other major tech companies such as Microsoft and Amazon, who have been investing into the expansion of their cloud computing capabilities and offerings to add another revenue growth channel beyond search advertising.

Shares of Google have served investors well over the past year as the stock yielded 23%. What’s more, the average analyst price target of $1,962.12 indicates shares have room to advance another 12% over the coming year.

Earlier this month, Robert W. Baird analyst Colin Sebastian raised the stock’s price target from $1,725 to $2,000 (14% upside potential) and reiterated a Buy rating.

Sebastian argued that the that strong e-commerce trends through the holiday shopping season benefitted the company, and digital-advertising visibility in 2021 was improving. The analyst added that an expected recovery in travel, recreation and automotive ads could contribute to a long-term valuation for GOOGL of $3,000 a share.

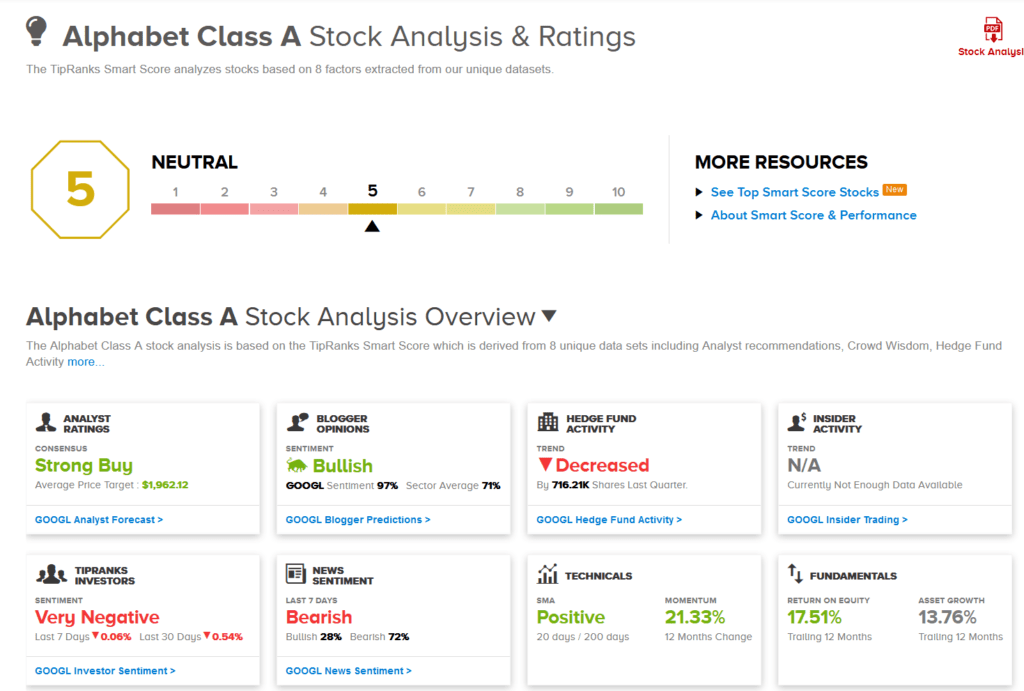

Overall, Wall Street analysts remain firmly bullish on the stock. The Strong Buy analyst consensus boasts 26 Buys versus 2 Holds. (See GOOGL stock analysis on TipRanks)

Meanwhile, TipRanks’ Smart Score on GOOGL is a neutral 5, which implies that the stock is most likely to perform in line with market averages.

Related News:

T-Mobile Inks Multi-Billion Dollar 5G Deals With Nokia, Ericsson

Tesla Asked To Recall 158,000 Vehicles Due To Safety Concern; Shares Drop

Apogee Raises Quarterly Dividend By 7%; Shares Gain