Alphabet’s (NASDAQ:GOOGL, GOOG) Google has set a new AI policy on election ads. The tech company is making it mandatory for election advertisers to “prominently disclose” the use of artificial intelligence or AI-generated content. The new policy, which is applicable to AI-generated images, videos, and audio content in election-related ads, will become effective mid-November.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Google’s Updated Political Content Policy

Google provided examples of some ads that would require clear and conspicuous disclosure, including an ad with “synthetic” or AI content that makes it seem as if a person is saying or doing something that he or she didn’t say or do. Another example is an ad with AI content that modifies footage of “a real event or generates a realistic portrayal of an event to depict scenes that did not actually take place.”

Google added that any synthetic content that is altered for minor changes like image resizing, cropping, or brightening corrections is exempted from these updated disclosure requirements.

Google’s policy update comes a year ahead of the U.S. presidential and congressional elections. The rise in the use of generative AI models, like Microsoft (NASDAQ:MSFT)-backed OpenAI’s ChatGPT, has sparked fears about altered content deceiving voters. In particular, deepfakes are making it difficult to differentiate between the real and the fake. Deepfakes are created from a type of machine learning technology to replace, modify, or mimic someone’s face in video or voice in audio.

Google and other companies like Meta Platforms (NASDAQ:META) have been facing increased pressure to curb misinformation on their platforms. In June, the European Union urged social media platforms, including Google and Facebook, to label AI-generated content and images as part of its fight against fake news and misinformation.

Interestingly, on September 13, top tech executives, including Alphabet CEO Sundar Pichai, Microsoft CEO Satya Nadella, Meta CEO Mark Zuckerberg, and Tesla (NASDAQ:TSLA) CEO Elon Musk, would be attending an artificial intelligence forum, called AI Insight Forum, hosted by Senate majority leader Chuck Schumer in Washington. This forum is expected to help in framing the regulations related to AI.

What is the Target Price for GOOGL Stock?

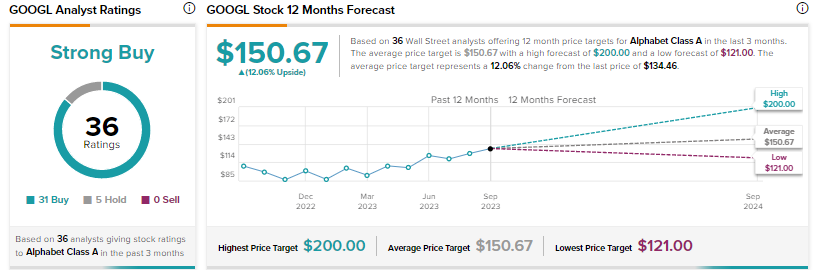

With 31 Buys and five Holds, GOOGL stock earns Wall Street’s Strong Buy consensus rating. The average price target of $150.67 implies 12% upside potential. Shares have rallied more than 52% year-to-date.

Investors should note that JPMorgan analyst Doug Anmuth is the most accurate analyst for GOOGL stock, according to TipRanks. Copying the analyst’s trades on GOOGL and holding each position for one year could result in 87% of your transactions generating a profit, with an average return of about 24% per trade.