Tech giant Alphabet’s (NASDAQ:GOOGL) (NASDAQ:GOOG) Google Cloud division launched Blockchain Node Engine to ease the capabilities of Ethereum (ETH-USD) developers. Nodes are storage devices, including a computer, laptop, or server that run the codes for blockchain networks. Nodes carry and transfer huge amounts of blockchain data. A larger number of nodes on a network ensures a more secure, scalable, and decentralized network.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Google’s Blockchain Node Engine offers node-hosting services that developers usually self-manage and require constant supervision. Google’s Blockchain Node Engine does continuous monitoring of the nodes and also restarts the disrupted ones.

Thanks to Google’s powerful Cloud platform, the service will ensure that no Denial-of-service (DDoS) attacks take place on the network. Moreover, Google’s nodes will allow developers to customize the permissions behind a VPC (virtual private cloud) firewall.

Google acknowledges the importance and prospects of the Web3 development space and intends to be a significant player. The initial launch of Google’s Blockchain Node Engine is only available for Ethereum developers. Google hopes to offer the service to other crypto developers in the future.

Alphabet recently reported Q3FY22 results that fell short of analyst expectations on both the revenue and earnings fronts. However, the company’s Google Cloud segment was the only one to show sequential growth.

Is Google a Good Stock to Invest in?

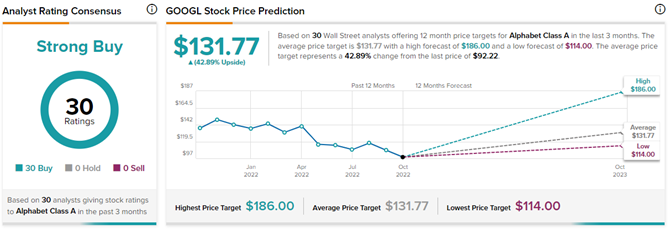

Despite the weak quarterly performance and a series of price target cuts, Google continues to be a much-favored stock. With 30 unanimous Buy ratings, GOOGL stock commands a Strong Buy consensus rating on TipRanks. The average Alphabet price target of $131.77 implies 42.9% upside potential to current levels. Meanwhile, GOOGL stock has lost 36.4% so far this year due to the overall industry downturn and macro headwinds.