Alphabet-owned Google (NASDAQ:GOOGL, GOOG) plans to remove Canadian news from search results and other products on its platform due to a new Canadian law that requires the company to make payments to local news publishers. Google joins Meta Platforms (NASDAQ:META), the owner of Facebook and Instagram, which made a similar announcement last week to indicate its opposition to the new legislation.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Google Opposes Online News Act

The new legislation, called the Online News Act, is expected to be effective in about six months. The new law aims to help struggling Canadian media outlets get better compensation from tech giants. Several domestic publishers have been under pressure due to the shift in advertising revenue to digital platforms.

In a statement, Kent Walker, the president of global affairs at Google and Alphabet, called the Online News Act “unworkable” and thinks that it would not address the structural issues with the legislation. The company has been contending for a while that this Act is a wrong approach to support Canadian journalism. Google thinks that the Act will make it “untenable” for the company to continue offering its Google News Showcase product in the country.

“The unprecedented decision to put a price on links (a so-called “link tax”) creates uncertainty for our products and exposes us to uncapped financial liability simply for facilitating Canadians’ access to news from Canadian publishers,” said Kent.

Kent further explained that Google already supports Canadian journalism through its programs and partnerships. He highlighted that the platform linked Canadian news publications over 3.6 billion times for free in 2022 alone, which enabled publishers to generate money through ads and new subscriptions. He estimates that such referral traffic from links has been valued at Canadian Dollars 250 million per year.

Expressing disappointment, Kent said that none of the company’s suggestions to make changes to the C-18 bill, before it was passed into law, were accepted. It is interesting to note that Google and Facebook were able to strike deals with some Australian media companies in 2021 after similar legislation was amended. However, the Canadian government currently doesn’t seem to be interested in negotiations, with Prime Minister Justin Trudeau accusing Google parent Alphabet and Meta of using “bullying tactics.”

Is It Good to Buy GOOGL Stock Now?

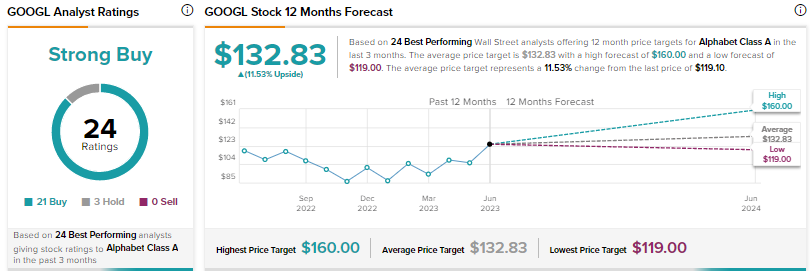

Of the 24 Top Wall Street Analysts covering GOOGL stock, 21 have a Buy rating while three have a Hold recommendation. The average price target of $132.83 implies nearly 11.5% upside. It is worth noting that the top analysts have an impressive track record of generating attractive returns from their recommendations. Moreover, each analyst has a remarkable success rate.

Earlier this week, Oppenheimer analyst Jason Helfstein reiterated a Buy rating on Alphabet and a price target of $145. The analyst expects the advertising backdrop to be stable or improve during the third quarter. While Helfstein did not raise his estimates, he said that he has a “positive bias” for the revenue estimates for the second half of the year.

Further, he believes that the consensus estimate for the 2024 top line is “reasonable” but “not bullish.” Meanwhile, he thinks that Wall Street’s consensus margin estimate seems “bearish,” as it doesn’t account for the company’s efforts to streamline its staffing levels.