Google (GOOGL) announced on Thursday that it has signed the first corporate agreement in the U.S. to purchase electricity from a power plant that uses carbon capture and storage (CCS). The electricity will help power Google’s data centers in the Midwest. Notably, with the U.S. power grid under strain, tech giants like Google are investing in new energy sources. More specifically, Google has signed power deals in recent months with nuclear, geothermal, and hydropower companies and is working with PJM Interconnection—the country’s largest power grid—to speed up energy connections.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new deal involves a 400-megawatt power plant in Decatur, Illinois, developed by Low Carbon Infrastructure. The plant will use CCS technology to trap about 90% of the carbon emissions and store them underground. It’s expected to begin operating in the early 2030s. While financial details weren’t shared, final investment decisions are expected in the first half of 2026. Michael Terrell, Google’s head of Advanced Energy, said that natural gas power with CCS had been missing from the firm’s clean energy plans and called this deal an “important piece of the puzzle.”

Interestingly, the plant will be built at an existing Archer Daniels Midland (ADM) industrial site, which already has experience storing carbon dioxide underground from ethanol production. Moreover, the project is expected to take four years to build and will create 650 union jobs and 100 support roles. ADM will also have the option to buy power from the plant, which will first supply electricity to the Midcontinent Independent System Operator that serves 15 Midwest states and several Google data centers.

Is Google Stock a Good Buy?

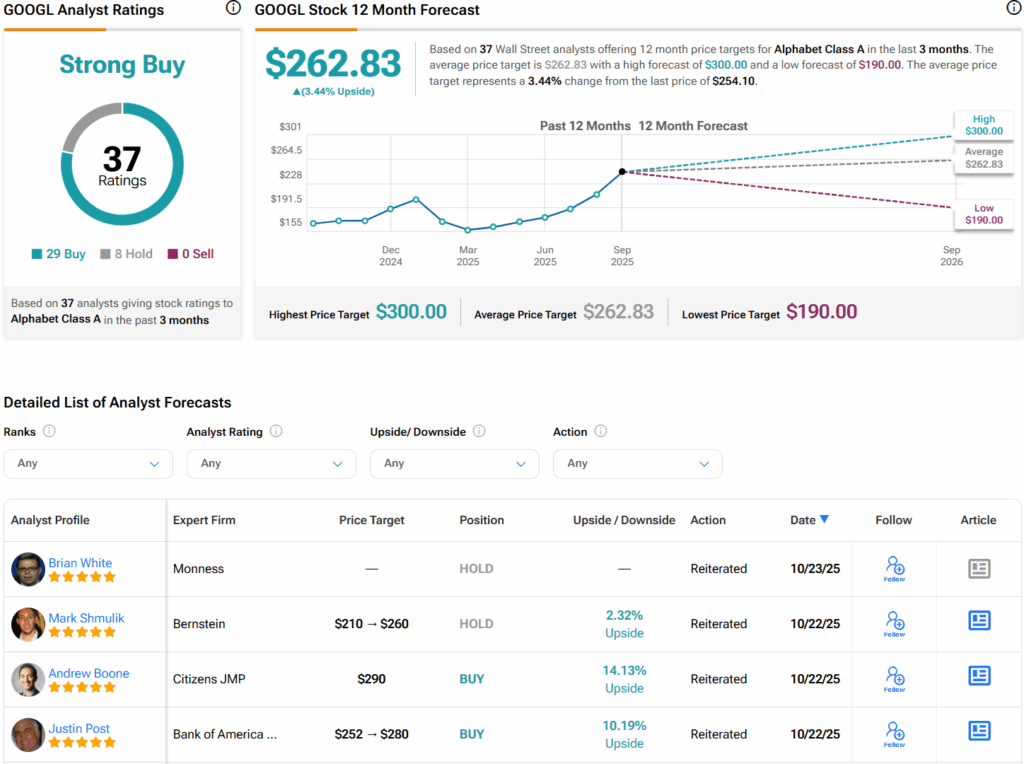

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 29 Buys and eight Holds assigned in the past three months. Furthermore, the average GOOGL price target of $262.83 implies that shares are trading near fair value.