Alphabet Inc. (GOOGL), the tech giant behind Google, continues to capture investor attention amid its AI initiatives, digital advertising dominance, and expanding cloud business. With solid fundamentals and a history of innovation, it remains a key pick for long-term tech investors. Notably, the TipRanks A.I. Analyst forecast aligns with Wall Street’s bullish outlook on GOOGL stock, highlighting confidence in the company’s long-term prospects.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, TipRanks’ A.I. Stock Analysis provides automated, data-backed evaluations of stocks across key metrics, offering users a clear and concise view of a stock’s potential.

GOOGL Earns an Outperform Rating

According to TipRanks’ A.I. Stock Analysis, Google has earned a score of 79 out of 100 with an Outperform rating. The score reflects strong financial performance and growth potential, especially in AI and cloud services. The tool also highlights positive and negative factors influencing the company’s stock performance.

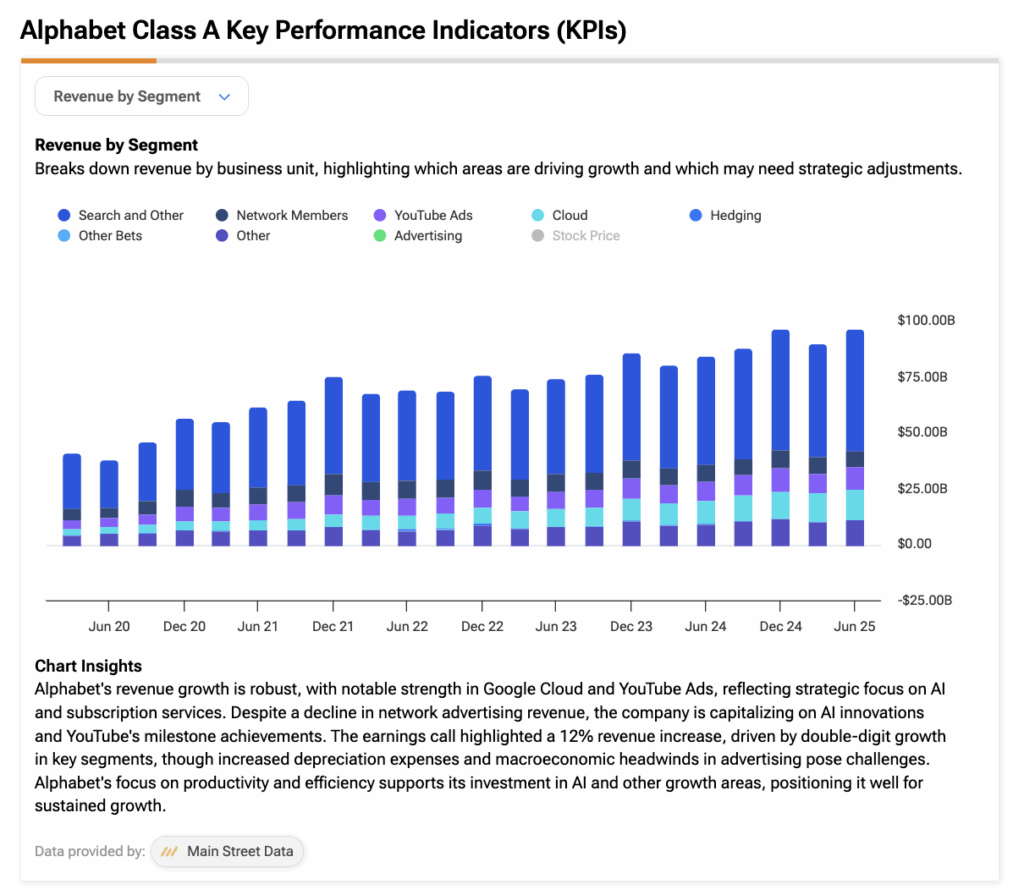

On the positive side, Alphabet has shown strong revenue growth across key segments, including Search, YouTube, and Cloud, reflecting robust business expansion and high market demand. Additionally, strong cash generation provides the financial flexibility to fund strategic investments, supporting long-term resilience and business stability. Below is a screenshot showing its revenue across multiple segments.

Google’s Challenges that Investors Should Watch

On the downside, Alphabet faces several potential challenges that could impact its performance. Legal issues and significant fines may affect profitability and require adjustments to business practices, influencing its competitive position.

Rising operating expenses, including higher legal and compliance costs, could pressure margins and limit financial flexibility, affecting long-term earnings. Moreover, supply constraints in cloud services may slow growth and restrict the company’s ability to meet rising demand, potentially impacting revenue expansion.

Are Google Shares a Good Buy?

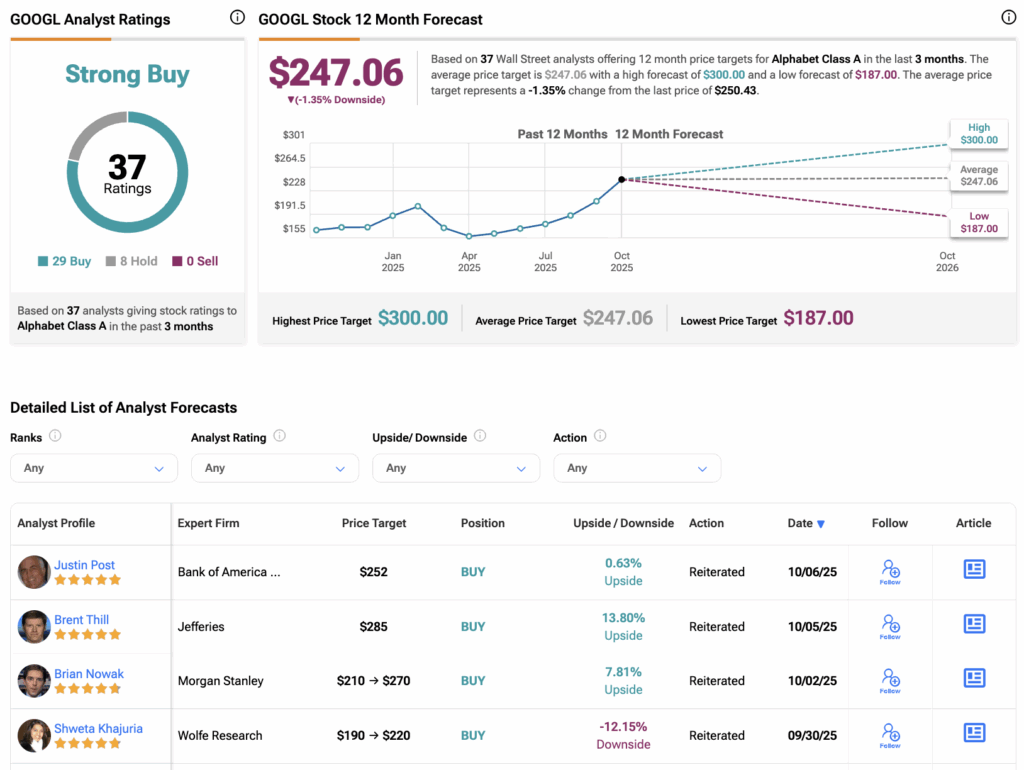

According to TipRanks, GOOGL stock has received a Strong Buy consensus rating, with 29 Buys and eight Holds assigned in the last three months. The average Google stock price target is $247.06, suggesting a potential downside of 1.35% from the current level.