TipRanks’ Top Hedge Fund Managers tool allows users to track the investment portfolios and holdings of leading financial professionals. Today, we have focused on the three top picks – Alphabet (NASDAQ:GOOGL), Block (NYSE:SQ), and Microsoft (NASDAQ:MSFT) – of a leading hedge fund manager David Gladstone from Gladstone Capital Management.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to the rankings, Gladstone is eighth among the 483 hedge fund managers evaluated by TipRanks. It should be noted that he has delivered exceptional performance, with a cumulative gain of 359.69% since June 2013 and an average return of 23.68% over the past 12 months.

Additionally, a hedge fund manager’s return on a portfolio is best measured by the Sharpe ratio, which measures the portfolio’s returns against its risks. A Sharpe ratio greater than one means that the portfolio has higher returns than risks. Gladstone has a Sharpe ratio of 4.63.

With this background, let’s explore what the Street is saying about the hedge fund manager’s top picks.

Is GOOGL a Buy, Sell, or Hold?

Alphabet is a tech giant known for its search engine Google. Strong momentum in the company’s cloud segment and opportunities in the advertising business provide a solid foundation for future growth. The company’s investments in artificial intelligence (AI) and its integration into its products are other encouraging factors.

With an exposure of 20.76%, GOOGL occupies the first position in Gladstone’s portfolio.

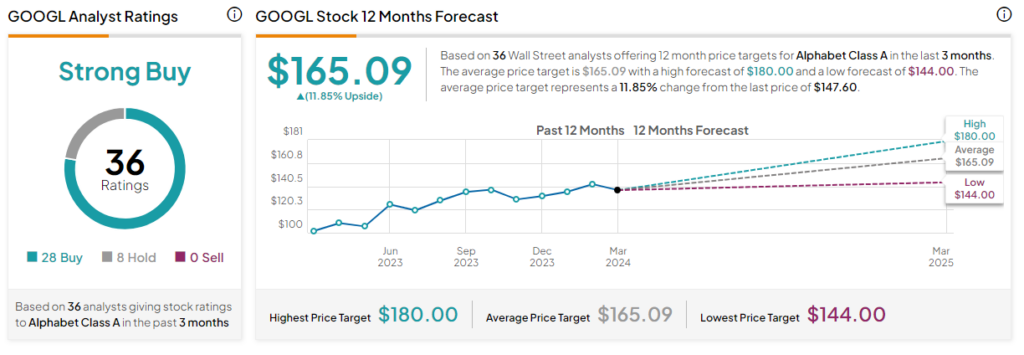

Alphabet has a Strong Buy consensus rating based on 28 Buys and eight Holds. Further, the analysts’ average price target on GOOGL stock of $165.09 implies a 11.85% upside potential to current levels. Shares of the company have gained 13.3% over the past six months.

Is Block a Buy or Sell?

Block operates as a financial services and digital payments company. Focus on implementing cost-control measures and efforts to strengthen its merchant ecosystem bode well for the company’s long-term growth.

SQ is the second-largest holding in Gladstone’s portfolio, with an exposure of about 15.47%.

With 27 Buy and four Hold ratings, Block stock commands a Strong Buy consensus rating. On TipRanks, the analysts’ average price target on SQ stock of $90.59 implies 7.78% upside potential from current levels. Over the past six months, shares of the company have gained 88%.

Is MSFT Stock a Good Buy Now?

Microsoft is a multinational technology company known for its software products, including the Windows operating system and its Microsoft Azure cloud computing services. The company’s strong presence in the operating system and software development market, investments in AI, and expansion of the cloud computing and gaming businesses are expected to continue supporting its growth.

Microsoft stock constitutes 12.51% of Gladstone’s portfolio.

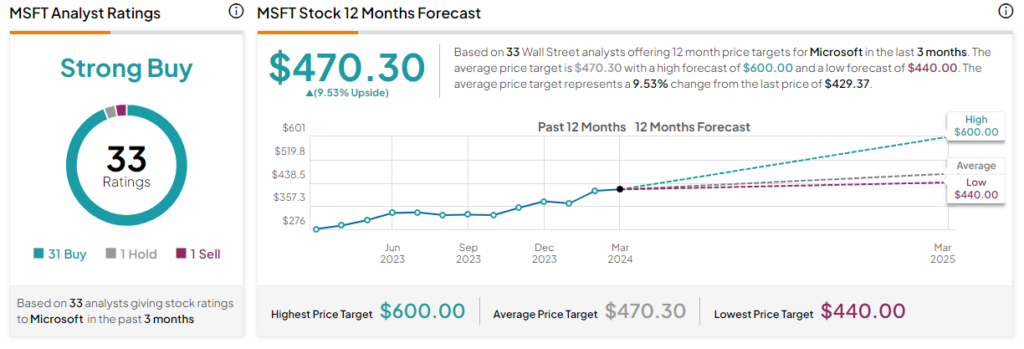

On TipRanks, MSFT stock has a Strong Buy consensus rating. This is based on 31 Buys, one Hold, one Sell recommendation. The average price target of $470.30 implies 9.53% upside potential. Shares of the company have gained 36% over the past six months.

Concluding Thoughts

Impressive portfolio gains of the leading hedge fund managers may encourage investors to adopt their portfolio allocation strategy. For more ideas on Top Expert Picks, investors can visit the TipRanks Expert Center and make informed investment decisions.