On Wednesday, Alphabet (NASDAQ: GOOGL) told Reuters that the U.S. Department of Justice’s (DoJ) complaint regarding the search engine giant’s dominance over the digital advertising market was “without merit” and the company would “defend itself vigorously.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The DoJ stated on Tuesday that Google should be asked to sell its ad manager suite as it dominates the advertising market. Advertising accounts for 80% of GOOGL’s overall revenue.

On its part, GOOGL pointed out that the government was “doubling down on a flawed argument that would slow innovation, raise advertising fees and make it harder for thousands of small businesses and publishers to grow.”

Following this lawsuit, top-rated analyst Stephen Ju from Credit Suisse commented, “In the event that Google were to lose the lawsuit, presumably there may be a divestiture of the display advertising business and in that scenario shareholders will be otherwise compensated for the loss in free cash flow, so the actual potential value destruction will theoretically be much less than the 8-9%.”

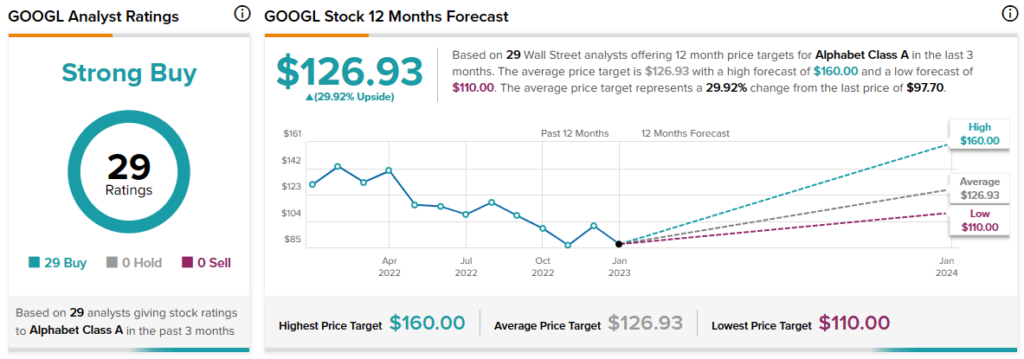

The analyst reiterated a Buy rating and a price target of $145 on the stock. Ju’s price target implies an upside potential of 48.4% at current levels.

Overall, analysts remain bullish about GOOGL stock with a Strong Buy consensus rating based on 29 unanimous Buys.