The Goodyear Tire & Rubber Company (NASDAQ:GT) approved a strategic optimization initiative for its APAC (Asia Pacific) region to enhance its profitability in Australia and New Zealand. This proposed initiative entails a shift in its operational model, including transitioning from a company-owned approach to a third-party distribution and retail sales model.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Consequently, the tire company anticipates cutting 700 jobs. Moreover, GT will exit nine warehouse locations and 100 retail and fleet store locations.

The move is part of its broader initiative aimed at streamlining its business, bolstering its competitive stance, and fostering growth. The company will share details about the same during the fourth quarter conference call. Meanwhile, Goodyear said that the strategic overhaul in APAC will enhance the region’s operating income by an estimated $50 million to $55 million in 2025 and each subsequent year by lowering SG&A (selling, administrative, and general) expenses.

Goodyear is grappling with lower volumes and is focusing on cost-saving actions to cushion margins and support its financials. Investors should note that its worldwide tire unit sales in the first six months of 2023 were 82.6 million units, down 8.9% year-over-year. The decline reflects a weakness in replacement tire volume, driven by reduced industry demand. With this backdrop, let’s look at what the Street recommends for GT stock.

Is Goodyear a Good Stock to Buy Right Now?

While the company is witnessing lower volumes, its management remains confident that the improvement in industry demand, coupled with its actions to take out costs and support margin expansion, will drive its earnings.

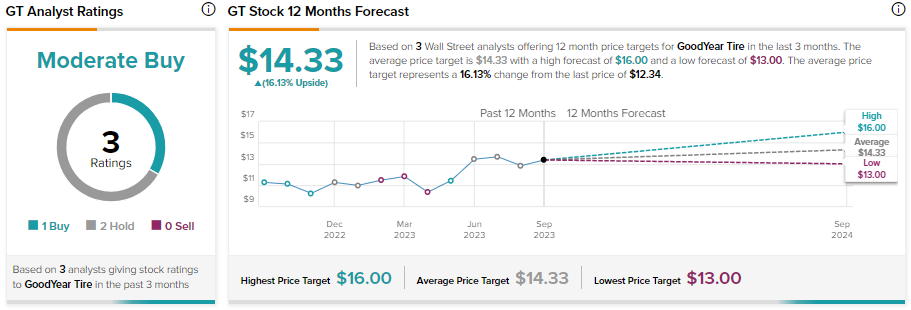

However, analysts remain cautiously optimistic about Goodyear stock due to near-term demand weakness. It has received one Buy and two Hold recommendations for a Moderate Buy consensus rating. GT stock has gained over 21% year-to-date. Meanwhile, analysts’ average price target of $14.33 implies 16.13% upside potential from current levels.