There’s no question about it: it was a bad day for GoodRx (NASDAQ:GDRX), as the stock that helps connect people to cheaper prescriptions plunged over 15% in Tuesday afternoon’s trading. The main reason is simple, and disturbing: an analyst downgrade following the news that other firms were planning to follow GoodRx into the fray.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Word from Bank of America and Bloomberg painted a potentially disastrous picture ahead, one that GoodRx would be hard-pressed to get out from under. Bank of America noted that GoodRx faced significant potential difficulties ahead, starting with “…near-term risks to valuation,” followed by “…intermediate-term risks to its earnings profile.”

That’s bad news, but it got worse: CVS (NYSE:CVS) brought out some changes that might make PBM reimbursement rates less volatile. Bank of America then cited a Bloomberg report noting that without that volatility, a lot of GoodRx’s room to run in the field is hampered. And if more drugstores adopt the CVS model, then that does a number on GoodRx.

Then the Big Blow Hit

Bank of America then delivered the coup de grace, cutting the rating from Buy to Underperform and the price target nearly in half, from $8 to $4.50. Bank of America even went so far as to note that several other firms were looking to get in on GoodRx’s market, including OptumRx and CarelonRx, among others, which would pose a serious competitive risk to GoodRx’s entire operation. In addition, given reports that the drug discount card market could rise at a compound annual growth rate of 8.1% between 2023 and 2030, the overall industry could be disrupted. That’s not good news for GoodRx; either it loses ground to competitors or to a sea change in the market.

What is the Target Price for GoodRx Stock?

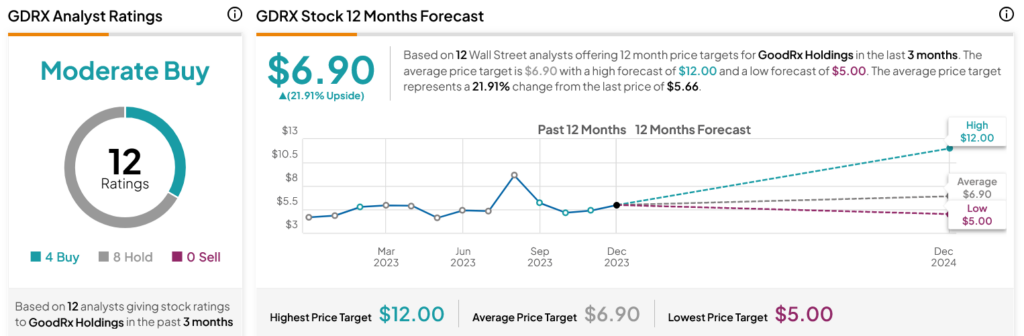

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GDRX stock based on four Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 19.96% rally in its share price over the past year, the average GDRX price target of $6.90 per share implies 21.91% upside potential.