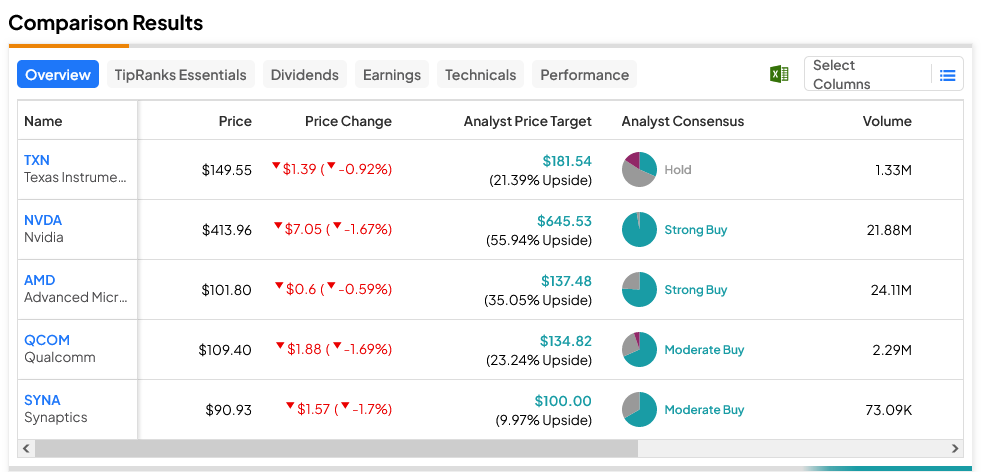

It should have been good news for chip stocks in Friday morning’s trading as a KeyBanc report emerged and gave us a surprisingly upbeat look at the chip sector. But despite this, several major chip stocks are down as the news apparently wasn’t good enough to overcome investor fears about the near term. Several chip stocks are down in Friday morning’s trading, including AMD (NASDAQ:AMD) and Texas Instruments (NASDAQ:TXN), which are down fractionally. Nvidia (NASDAQ:NVDA), Qualcomm (NASDAQ:QCOM) and Synaptics (NASDAQ:SYNA), meanwhile, are down somewhat more substantially.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

There was good news for the sector this morning, although you couldn’t tell it by looking at the sea of red ink. Word out of KeyBanc Capital Markets noted that there were “favorable” risk-reward profiles on several stocks, including AMD, Qualcomm, and Synaptics. Yet even here, there were concerns: AMD, for example, has some risk of a slower than expected ramp up on its Genoa chip line and some potential weakness on the MI300X launch in December. Qualcomm, of course, has broad exposure to smartphones, which haven’t been doing all that great lately but are still a vital market. And Synaptics may benefit from improved inventory levels, but it will have to normalize its inventories effectively to take advantage of that gain.

Unfortunately, some are less likely to do well. For instance, Nvidia is likely to take a hit from its increasingly shrinking China market as government regulation interferes with what chips it can and cannot sell into China. Throw in the growing slate of countries on the forbidden lists and it only gets worse. As for Texas Instruments, KeyBanc notes a “moderate” risk to those that are “analog semiconductors,” and Texas Instruments is one of the leaders in that sector.

Which Chip Stocks are Good Buys Right Now?

Turning to Wall Street, SYNA stock, a Moderate Buy, is the laggard in upside potential at 9.97% against an average price target of $100. Meanwhile, Strong Buy NVDA stock is the leader, with its average price target of $645.53 yielding an upside potential of 55.94%.