Gold prices have rallied by nearly 10% over the past month as a confluence of factors ensures that investors remain hooked to the yellow metal. Rising tensions in the Middle East and Ukraine are resulting in a steady safe-haven demand for gold. Additionally, the recent spate of healthy macro numbers, including manufacturing data and inflation figures, is keeping the timing of potential rate cuts uncertain.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Powell Announcement

Recent comments from U.S. Fed officials are only adding more fuel to the rally. This week, Fed Chair Jerome Powell noted that the recent inflation data do not significantly change the overall policy scenario for 2024, and rate cuts would happen sometime this year.

Moreover, the central bank opting for rate cuts before the economy hits the 2% inflation mark could prove to be a catalyst for gold prices. This year, gold could continue to attract buying interest as investors size up simmering geopolitical tensions and the uncertainty around the November elections. Notably, gold’s run above the $2,200/oz level potentially indicates investors sitting on the fence are beginning to join in on the rally.

What Is the Forecast for the Price of Gold?

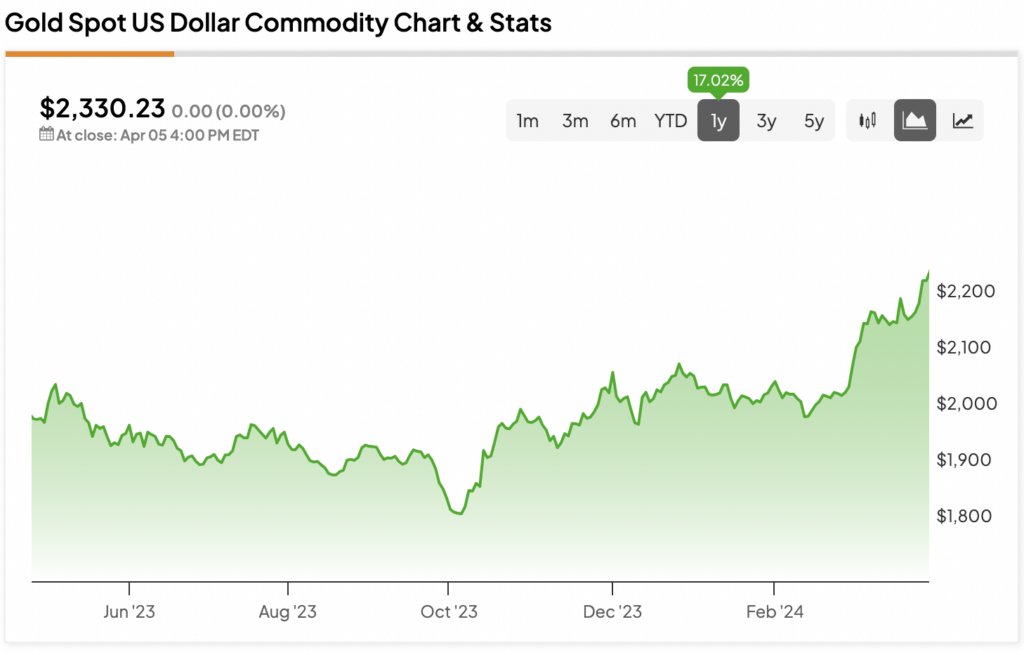

Looking at the Gold Spot US Dollar Commodity Chart, we can see that the current Gold-USD price is $2,330. This is a 17.02% increase from June 2023.

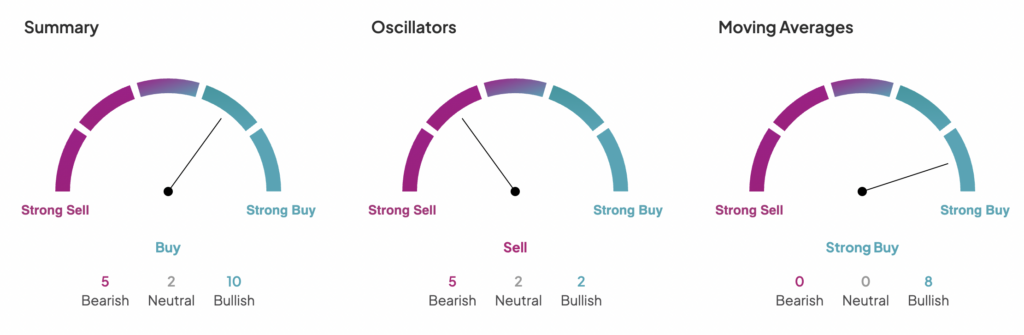

If we take a look at Gold’s Technical Analysis, we can see the summary sentiment suggests Gold is a Buy, and the moving averages suggest a Strong Buy.

Read full Disclosure