Goldman Sachs (NYSE:GS) is terminating its credit card partnership with Apple (NASDAQ:AAPL) and planning to sell its stake. However, this decision is expected to contribute to the firm’s losses as it might have to sell its holdings at a discount, a Reuters report indicated.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to the report, potential buyers perceive Goldman’s stake in the Apple Card as too risky and unprofitable. Consequently, there may be pressure from bidders for Goldman Sachs to lower the value of its stake to make the offer more appealing. This could result in a potential write-down, further adding to the firm’s losses.

Notably, there is mounting pressure on Goldman Sachs’ CEO David Solomon as he grapples with internal dissent. Additionally, the financial giant is attracting unfavorable media attention. Compounding these challenges is the bank’s lackluster financial performance, with a notable 34% year-over-year decline in net earnings for the first nine months of 2023.

Is Goldman Sachs a Buy or Sell?

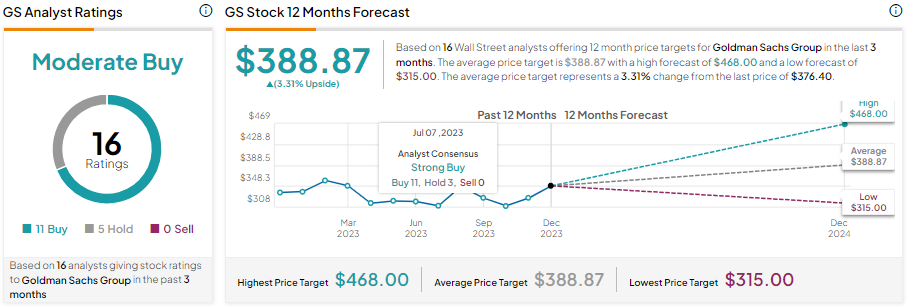

Wall Street is cautiously optimistic about Goldman Sachs stock. With 11 Buy and five Hold recommendations, GS stock has a Moderate Buy consensus rating. Further, the analysts’ average price target of $178.05 implies 15.56% upside potential from current levels.