Identity and access management company, Okta (NASDAQ: OKTA) got a boost on Monday after Goldman Sachs analyst Gabriela Borges upgraded the stock to a buy from a sell and raised her price target to $91 from $77. The analyst’s price target implies an upside potential of 23.2% at current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Borges commented, “We note the potential for volatility in the stock around earnings given our view that Street numbers may still see one more quarter of downward revisions.” The analyst added that “Even on lower revenue, we are 12% [to] 16% above the Street for FY25/FY26 free cash flow as we see the potential for meaningful margin expansion over the next 3 years.”

Shares of OKTA have lagged the broader market and have risen by only 6.7% this year. Borges has projected the company’s subscription revenues to rise from 14% in the second half of FY24 to be in the range of 15% to 20% in FY25. The analyst anticipates that the growth in subscription revenues is likely to be driven by factors including stabilizing sales productivity, the company grabbing more market share from legacy vendors, and building upon channel partnerships.

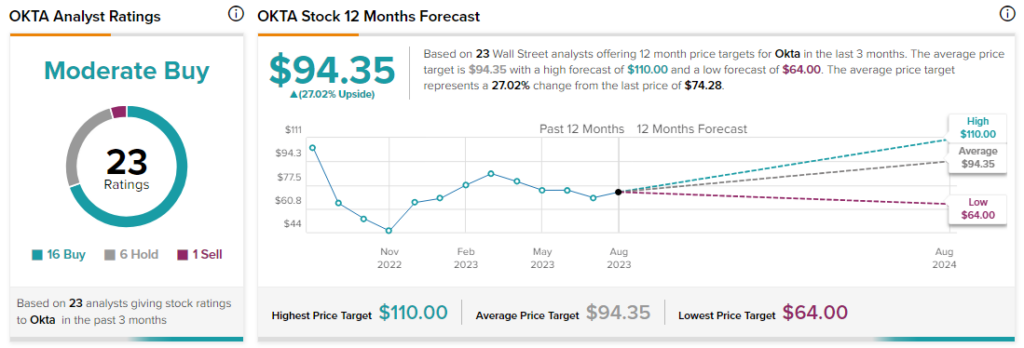

Analysts are cautiously optimistic about OKTA stock with a Moderate Buy consensus rating based on 16 Buys, six Holds, and one Sell.