Nvidia (NASDAQ:NVDA) stock now sits slightly above the historic $5 trillion market cap mark, a level that cements the company’s status as the defining force in the AI era. What began as a gaming-focused chip designer has evolved into the central engine of the global AI revolution, reshaping everything from data-center architectures to software development.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The thing is, it doesn’t look like this juggernaut is about to slow down anytime soon. With the company set to release FQ3 results on November 18, Goldman Sachs analyst James Schneider thinks the setup appears favorable once again.

“We believe expectations are high and investors are long into the print given recent AI infrastructure announcements and improved visibility into CY26 revenue trends,” Schneider said.

The analyst sees Nvidia delivering a beat-and-raise quarter, with the stock’s movement likely depending on the amount of upside in the guide. Schneider expects investor attention to focus on several key areas, including additional details on Nvidia’s $500 billion GPU and Networking revenue forecast outlined at GTC. Investors will also be looking for more insight into OpenAI’s deployments in 2026, particularly regarding timelines, industry readiness, and revenue impact. In addition, attention will be on the Rubin ramp in 2026, with investors watching product mix and the trajectory following launch. Lastly, the market will be eager to hear whether there’s potential for a resumption of business in China.

To reflect recent comments from management, upward revisions to hyperscaler CapEx, and other intra-quarter data, Schneider has increased his Datacenter segment revenue forecast by roughly 13%. The analyst’s Q3 and Q4 EPS estimates of $1.28 and $1.49 are 3% and 5% above Street expectations.

Looking further ahead, to incorporate management commentary and the upward revision to GS hyperscaler CapEx forecasts, Schneider has raised his revenue and non-GAAP EPS estimates by an average of 12% across his forecast period between fiscal year 2026 to 2028. Schneider’s revised FY27 and FY28 EPS estimates are 22% and 28% above the Street’s Visible Alpha (VA) estimates.

Following the earnings release, Schneider expects discussions will focus on the scale of upside in hyperscaler CapEx and the contribution from non-traditional customers in 2026, which will likely influence the stock’s moves through year-end.

“We expect the stock to continue to trade on quantitative datapoints that provide visibility to CY26 estimates,” the analyst added.

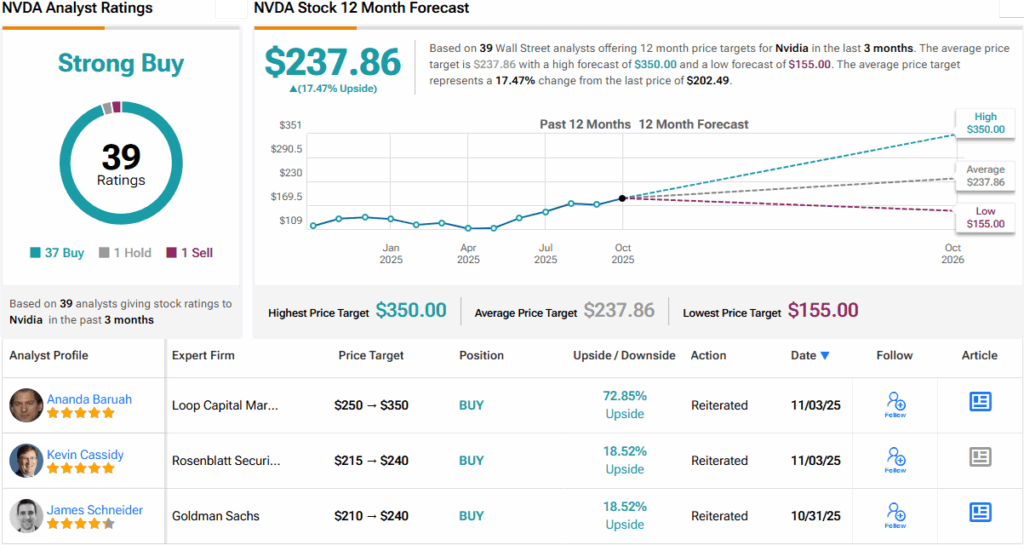

Putting it all together, Schneider remains firmly in the bull camp ahead of the earnings print. He assigns NVDA a Buy rating and bumps his price target from $210 to $240, implying 18.5% upside over the coming months. (To watch Schneider’s track record, click here)

Nvidia gets plenty of support elsewhere on the Street; based on a mix of 37 Buys, and 1 Hold and Sell, each, the stock naturally claims a Strong Buy consensus rating. Going by the $237.86 average price target, a year from now, shares will be changing hands for a ~17% premium. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.