UnitedHealth (NYSE:UNH) has faced growing friction with patients, healthcare providers, and regulators as a result of its adoption of stricter utilization management and coding practices in recent years. These measures have eroded the company’s brand perception and strained key relationships. The impact is evident in its share performance: since peaking last November, the stock has fallen 42%. In the meantime, the company announced several leadership changes, including reinstating Steve Hemsley as CEO and appointing Wayne DeVeydt, an external hire, as CFO.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These moves suggest that UnitedHealth is entering a period of reassessment and potential strategic reset, a view shared by Goldman Sachs analyst Scott Fidel, who believes that with new leadership at the helm, change is likely on the agenda.

“With the new management team in place, we expect the company will focus on easing stakeholder concerns, reviewing its business practices across the enterprise, while also implementing more conservative pricing to reflect upwardly revised medical cost baselines across many key business lines,” Fidel explained.

That shift is already being felt. During its second-quarter earnings call, UNH lowered its long-term margin targets for its key growth segments – Medicare Advantage and OptumHealth. Fidel argues that this revision played a major role in the stock’s sharp decline, as investors reacted to the reduced long-term EPS potential and “intrinsic value.” Even so, the analyst contends that the market’s reaction has gone too far, suggesting the selloff since April (when the company first cut its full-year profit outlook) “likely overstates” the true long-term impact on value.

Additionally, Fidel’s research suggests UNH’s Medicare Advantage margins are set to enter a cyclical recovery beginning in 2026, supporting his above-consensus adj. EPS forecasts for 2026–2028. The analyst estimates EPS of $16.40, $17.95, $21.30, and $25.30 for 2025E, 2026E, 2027E, and 2028E, respectively – above FactSet consensus of $16.23, $17.67, $20.88, and $26.79 – driven primarily by the expectation of a sustained margin rebound from 2026 through 2028.

Fidel also thinks the recent Medicare Advantage star ratings helped remove a “key short-term overhang.” On September 9, UNH said that it expects 78% of its members to be enrolled in 4-star or higher plans for 2026, based on preliminary data – essentially unchanged from 2025. That was better than investors had feared, especially given the rising cut points.

“The disclosure that MA STARs results should remain largely consistent also provides EPS stability and removes a key potential downside risk factor to the recovery should the STARs results have deteriorated,” Fidel noted on the matter.

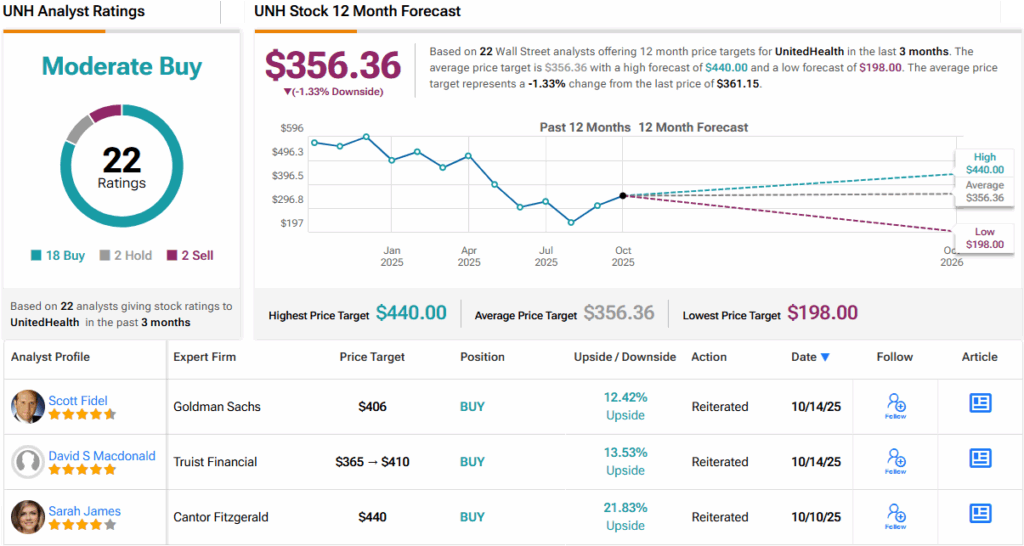

So, what does this all ultimately mean for investors? Fidel initiated coverage of UNH with a Buy rating and a $406 price target, implying the shares will climb 12% in the months ahead. (To watch Fidel’s track record, click here)

Elsewhere on the Street, the stock claims an additional 17 Buys, and 2 Holds and Sells, each, for a Moderate Buy consensus rating. However, the $356.36 average price target suggests the shares will stay rangebound for the time being. (See UNH stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.