Global investment banker Goldman Sachs (NYSE:GS) has decided to give up on GreenSky, and will be divesting the specialty lender unit at a loss. The step is aimed at shifting focus towards its core business of investment banking and trading. GS also warned that the sale of GreenSky will impact its third-quarter earnings by $0.19 per share. The company is scheduled to release its Q3 FY23 results on October 17, before the market opens.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

GreenSky primarily focuses on providing loans for home renovation projects.

Goldman is selling GreenSky to a group of private equity lenders led by Sixth Street, which includes other players like KKR &Co. (NYSE:KKR), Bayview Asset Management, and CardWorks. GS will continue operating the business until its sale is completed, which is expected in the first quarter of 2024.

The 19-cent hit to the Q3 bottom line includes impairment of GreenSky’s intangibles, adjustments to the valuation of its loan portfolio, higher taxes, and the countering effect of the release of loan reserves. In Q2FY23, GS had taken a similar hit of $504 million related to GreenSky’s asset impartment charges. GS stock has lost 7.5% so far this year.

GS’ Consumer Finance Ambitions Proved Costly

Under CEO David Solomon’s leadership, Goldman bought GreenSky last year for $1.7 billion, intending to expand its retail banking business. At the time, several past and current GS employees and well-wishers had objected to the acquisition. A few months later, Solomon realized the folly and started pursuing bids to sell off the fintech lending platform.

From 2020 until Q2FY23, GS lost roughly $4 billion (pre-tax) from its consumer financing businesses. Solomon’s decision to purchase GreenSky has proven costly as he is now ready to sell the same for a far lower amount. A Wall Street Journal report citing people familiar with the matter stated that the sale price could be close to $500 million. Furthermore, GS is seeking to sell off its credit card operations including those with Apple (NASDAQ:AAPL) and General Motors (NYSE:GM) to steer clear of any consumer financing businesses.

What is the Target Price for GS Stock?

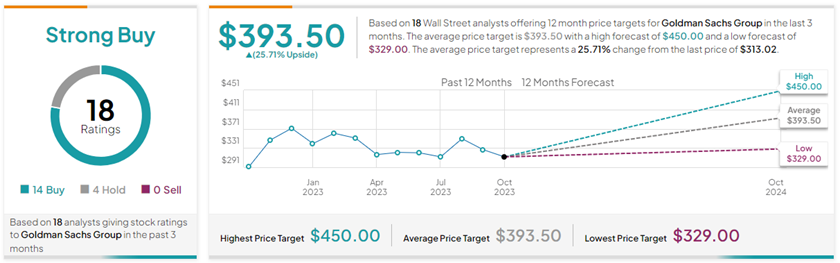

Following the news of the GreenSky sale, research firm KBW reiterated a Buy rating on GS stock. KBW has a price target of $400 on Goldman Sachs, which implies 27.8% upside potential from current levels.

Overall, Goldman Sachs stock commands a Strong Buy consensus rating on TipRanks. This is based on 14 Buys versus four Hold ratings. Also, the average Goldman Sachs price forecast of $393.50 implies 25.7% upside potential from current levels.