Financial services giant Goldman Sachs (NYSE:GS) is focusing on the burgeoning private credit market to bolster its growth rate. The firm’s asset management arm is embarking on an aggressive expansion strategy, aiming to grow its private credit portfolio from the current $130 billion to $300 billion within the next five years, Reuters reported.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Per the report, Goldman is diversifying its investment offerings to capture growth opportunities beyond traditional markets. Similarly, its peers plan to expand in the private credit market. However, Goldman’s ambitions in this sector are noteworthy due to its vast scale. For example, while Morgan Stanley (NYSE:MS) aims to increase its private credit portfolio to $50 billion in the medium term, Goldman Sachs’ aspirations in this domain surpass it by miles.

Goldman Sachs’ leadership, during the Q4 conference call, underscored the firm’s competitive edge, citing its strategic positioning within the banking landscape and ability to originate loans. Goldman intends to raise between $40 billion and $50 billion for alternative investments in the current year, with a significant portion—potentially at least a third—dedicated to supporting private credit strategies.

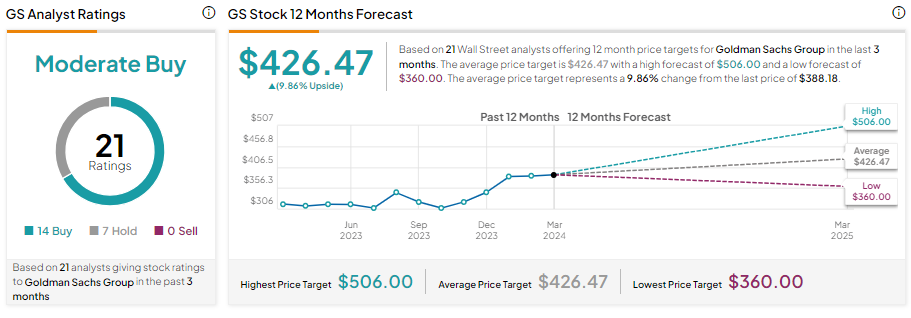

What is the Price Prediction for Goldman Sachs?

Goldman Sachs stock is up about 27% in one year, reflecting the banking giant’s efforts to drive profitability and shift from its previous consumer banking initiatives, which pressured its financials.

With 14 Buy and seven Hold recommendations, Goldman Sachs stock has a Moderate Buy consensus rating. Analysts’ average price target on GS stock is $426.47, implying an upside potential of 9.86% from current levels.