Financial services major Goldman Sachs (NYSE:GS) has delivered a mixed set of third-quarter numbers with EPS of $5.47, missing expectations by $0.05. Revenue rose by 8% sequentially to $11.82 billion, landing better than estimates by nearly $700 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Driven by gains in fixed income and currency and commodities (FICC), net revenue in Global Banking and Markets rose by 11% sequentially to $8.01 billion. Further, record management and other fees helped drive net revenue in the Asset and wealth Management vertical by 6% sequentially to $3.23 billion. Assets Under supervision at the end of the quarter stood at $2.68 trillion.

During the quarter, the company repurchased shares worth $1.50 billion and announced a dividend of $2.75 per share. The GS dividend is payable on December 28 to investors of record on November 30.

What Is the Target Price for GS?

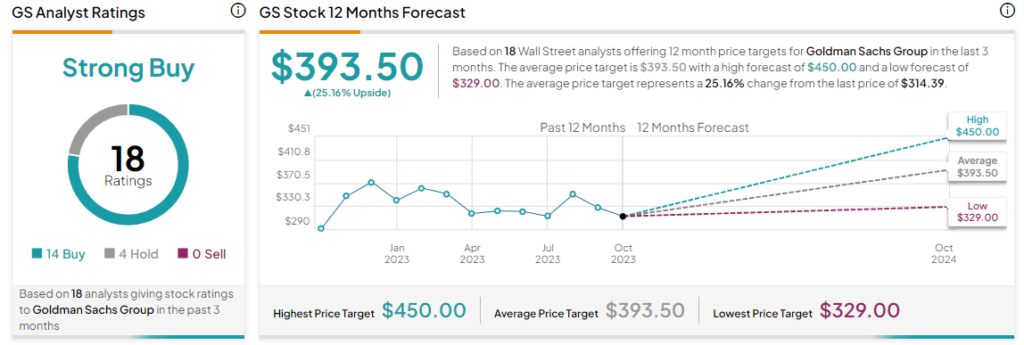

Overall, the Street has a Strong Buy consensus rating on Goldman Sachs. The average GS price target of $393.50 implies a 25.2% potential upside.

Read full Disclosure