Electric vehicle maker Rivian Automotive (NASDAQ: RIVN) is in a strange place right now. Despite faltering against major metrics, there are still those who think an explosive upside may be in store for the company. How can these two conditions exist at the same time? Though it seems odd, they do, and the company is up slightly going into Wednesday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Rivian did not have a great quarter, as it missed estimates that it had already cut. Originally, Rivian set out to produce 50,000 vehicles. Later in 2022, it cut those estimates in half, dropping the production target to 25,000. However, it produced 24,337 vehicles instead. The main culprit was supply chain issues that hit the company hard enough that the stock recently reached a 52-week low.

Enter Morgan Stanley (NYSE:MS) via analyst Adam Jonas. Jonas noted that the company indeed had a rough go of things, but it was still quite a bit better than it was previously. Though the company set high targets, cut them down, and then still missed, Rivian ultimately increased its production and deliveries alike on a quarter-to-quarter basis throughout the year. In fact, Jonas noted, fourth quarter deliveries managed to land a whopping 550% increase. Jonas then maintained an “overweight” recommendation and left the price target of $55 per share alone.

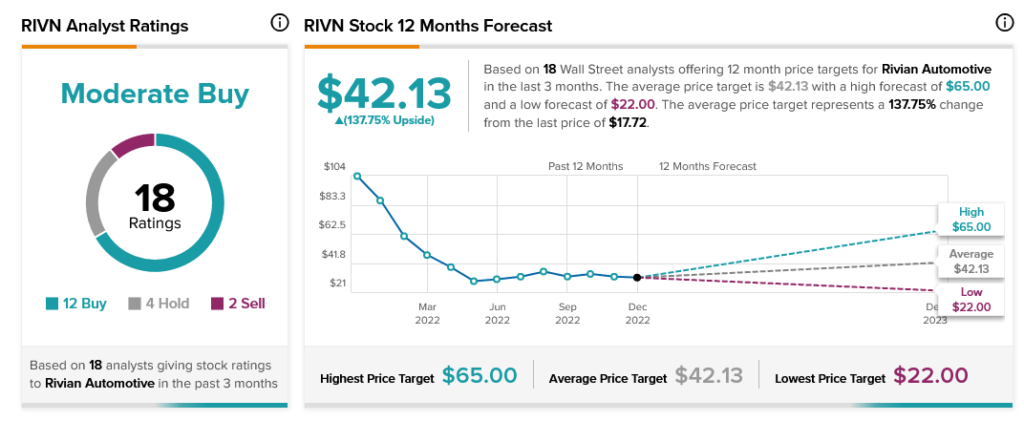

Wall Street, meanwhile, shares Jonas’ cautious optimism. Analyst consensus calls Rivian a Moderate Buy. Further, the stock’s current average price target of $42.13 suggests 137.75% upside potential.