Wall Street investment bank Goldman Sachs (GS) is forecasting that U.S. stocks will rally into year’s end.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In a bullish note to clients, Goldman Sachs says that a resilient U.S. economy and interest rate cuts from the U.S. Federal Reserve should keep stocks running higher for the rest of 2025 and investors should expect a so-called Santa Claus rally in December.

“The business cycle slowdown has continued, but recession risk remains anchored while monetary and fiscal policy easing accelerates, creating still favorable macro conditions for risk assets,” writes Goldman Sachs in its latest market assessment.

Neutral on Bonds

The analysts at Goldman Sachs also note that stocks tend to perform well in cases where interest rates are lowered even though the risk of a recession is low, citing the late 1990s as an example. Economists at Goldman Sachs expect two more interest rate cuts from the Federal Reserve this year and two in 2026.

While Goldman is bullish on equities, the investment bank says that it remains neutral on bonds for the next three to 12 months. In the note, Goldman writes that they see “little scope for large declines in bond yields without a material weakening in growth data, which would in turn result in a more dovish pivot from global central banks.”

Is GS Stock a Buy?

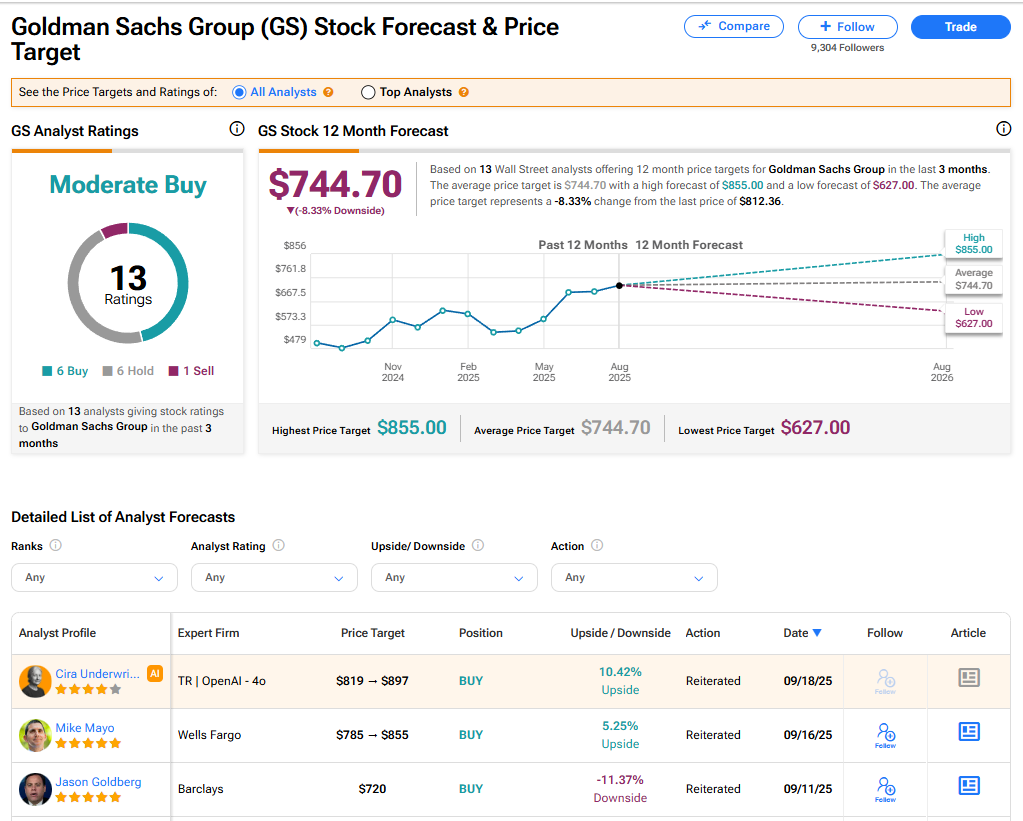

The stock of Goldman Sachs has a consensus Moderate Buy rating among 13 Wall Street analysts. That rating is based on six Buy, six Hold, and one Sell recommendations issued in the last three months. The average GS price target of $744.70 implies 8.33% downside from current levels.