It’s almost time for Micron (NASDAQ:MU) to unveil its latest quarterly statement. On Wednesday (December 20th), the memory giant will step up to deliver its fiscal first quarter results (November quarter).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

We already have an idea about some of what’s on the menu, given the company provided a pre-announcement last month. The company’s revised outlook for the quarter factored in revenue of roughly $4.70 billion, up from the previous estimate of ~$4.40 billion.

Stifel analyst Brian Chin says the update “confirmed what was evident – pricing is a big tailwind to revenue. Yet with utilization persisting at lower levels, regaining profitability hinges foremost on the rate of GM improvement.”

That should happen too, as the company also said non-GAAP gross margins are expected to nearly break even, contrasting with the earlier forecast of -4.0%. While Chin admits he was looking for bigger progress than that, he notes management also said GMs should turn positive in F2Q (February quarter).

Nevertheless, on pricing, Chin sees Micron being “directionally upbeat,” and guiding for F2Q revenue into the mid-$5 billion range (higher than Chin’s $5.2 billion estimate), with a “narrower loss in the quarter tied to the GM guide.”

As far as reaching profitability once again, Chin (as does consensus) expects that to take place in F4Q (August quarter). While here, the analyst would like to see that happen beforehand, he notes that unlike peers, Micron does not have the HBM (high-bandwidth memory) card up its sleeve, i.e., a “premium product in high demand that could shorten the path to profitability.”

Over time, Chin anticipates Micron will improve its standing in this regard, as indicated by the management team highlighting more substantial contributions expected later in the calendar year. One variable to take into account is whether customers accelerate their procurement in anticipation of future price increases.

All told, Chin maintained a Hold rating yet raised his price target from $72 to $76. However, the new figure still represents downside of 7.5% from current levels.

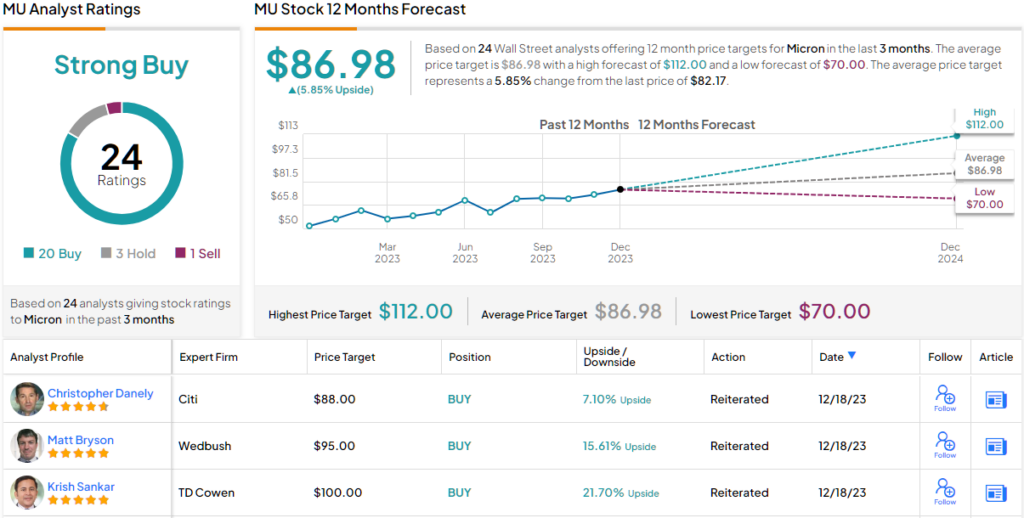

On Wall Street, Chin is amongst a skeptical minority. 2 others join him on the fence, and while one takes a bearish stance, all 20 other reviews are positive, naturally culminating in a Strong Buy consensus rating. However, the upside appears capped; going by the $86.98 average price target, a year from now, investors will be recording modest gains of ~6%. (See Micron stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.