Goeasy (TSX:GSY) (OTHEROTC:EHMEF) is one of the biggest names in alternative lending in Canada. And it just delivered quite a quarter, sufficient to draw the attention of investors and send shares skyrocketing up over 3% in Thursday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

It was a clear win for goeasy, as it brought in earnings per share of $3.81 Canadian, and revenue of $322 million Canadian. Revenue proved a particular winner as it not only blew away analyst projections calling for $230.43 million, but it also represented a gain of 22.9% against the third quarter of 2022. Loan originations and the overall portfolio size were both also on the rise, as more Canadians turned to goeasy loans for a variety of reasons.

While rising interest rates have prompted some trouble kicking off loan originations for Canadian banks, goeasy hasn’t had that trouble. In fact, reports note that goeasy saw a “record volume of applications” for credit in this quarter, leading to the aforementioned growth in loan originations and overall loan value. What’s more, this isn’t the first time that goeasy turned in a winner; reports note that this is just the latest win for goeasy in earnings against analyst estimates. But given that goeasy offered no updates on guidance going forward, or any word on when it will be able to pull back on interest rates on those loans. That might be limiting goeasy’s share price performance, by some reckoning.

Is Goeasy Stock a Buy, Sell, or Hold?

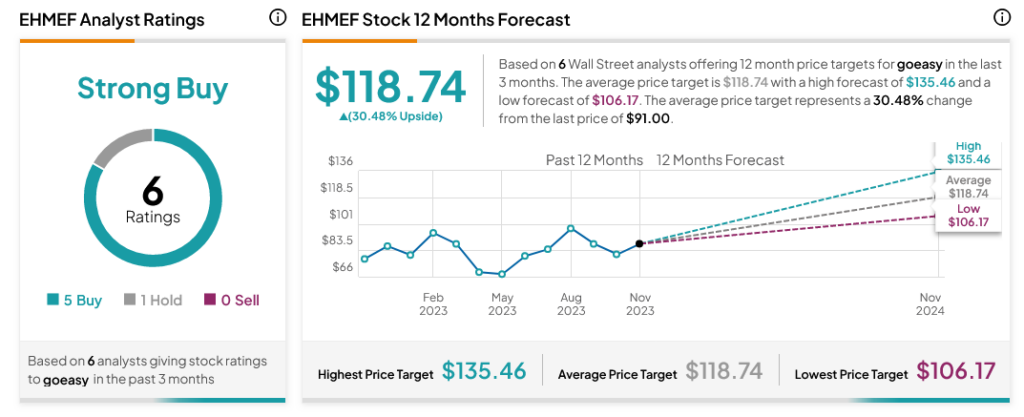

Turning to Wall Street, analysts have a Strong Buy consensus rating on EHMEF stock based on five Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average EHMEF price target of $118.74 per share implies 30.48% upside potential.