Arizona-based GoDaddy, Inc. (NYSE: GDDY) has signed accelerated share repurchase (ASR) agreements with Morgan Stanley (NYSE: MS) and Goldman Sachs (NYSE: GS) to buy back common shares worth $750 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The agreements are expected to be settled in the second quarter of this year.

The ASR agreements form a part of the company’s multi-year $3 billion share repurchase plan announced along with the release of the fourth-quarter results on February 10.

Since 2018, GoDaddy has repurchased around 24 million common shares for nearly $1.53 billion.

The CFO of GoDaddy, Mark McCaffrey, said, “We are committed to delivering value to shareholders through reducing our share count over time.”

GoDaddy is an Internet domain registrar and web hosting company. It ended last year with 20 million customers and more than 9,000 employees across the world.

Wall Street’s Take

On January 14, Morgan Stanley analyst Elizabeth Elliott maintained a Hold rating on the stock and raised the price target to $95 from $81 (18.2% upside potential).

Additionally, Ygal Arounian of Wedbush reiterated a Buy rating on GoDaddy and increased the price target from $92 to $100 (24.4% upside potential).

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys and 3 Holds. The average GDDY price target of $103.67 implies 29% upside potential. Shares have lost 5.5% over the past year.

Website Traffic

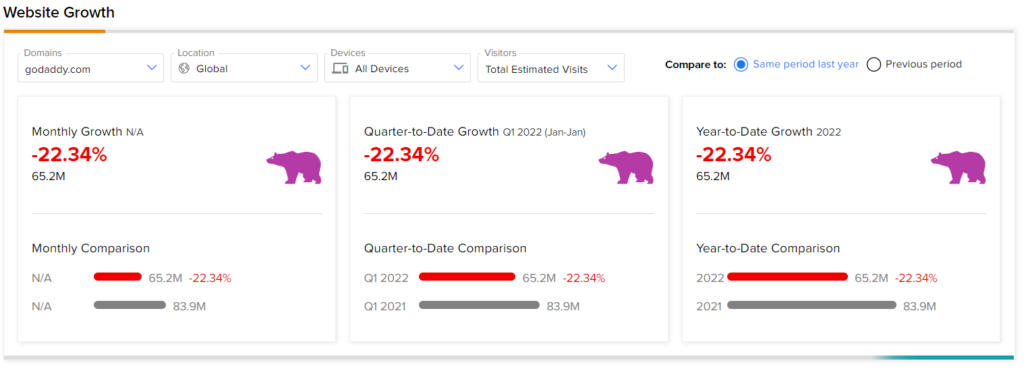

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into GoDaddy’s performance.

According to the tool, compared to the previous year, GoDaddy’s website traffic has registered a 22.3% decline in global visits year-to-date.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Copper Mountain Mining Posts Lower Q4 Production

Mr. Cooper Group Gains 19% on Q4 Earnings Beat & New Partnership

Transdigm Group Updates 1 Key Risk Factor