Sometimes, a little extra push from analysts is needed to help improve a stock’s outlook. Indeed, that was all it took for web hosting stock GoDaddy (NYSE:GDDY) to add nearly 2% to its share price in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

GoDaddy greased the wheels a bit by offering up an investor dinner, which brought analysts out, and Benchmark’s Mark Zgutowicz offered up some post-dinner commentary. Zgutowicz noted that GoDaddy’s “operating leverage,” as well as its odds for producing solid revenue growth in 2024, looked quite good. The whole package was enough for Zgutowicz to not only leave his Buy rating in place but also hike his price target, sending GoDaddy up from $96 to $125 per share.

Further Gains May Yet be Afoot for GDDY

GoDaddy has a reasonable investment theory along with it. As it pointed out, it’s the kind of operation that readily facilitates small businesses. And small businesses, it notes, have a disproportionately large impact on the business landscape. They create jobs and improve wages accordingly by creating more competition against a handful of large firms. As a result, Zgutowicz also called out the Airo project, an AI-driven operation that provides help for companies looking to design a presence from the ground up. This is great for starter operations, and with side hustles increasingly in vogue, it might be just what’s needed to stimulate revenue growth.

Is GoDaddy a Good Stock to Buy Now?

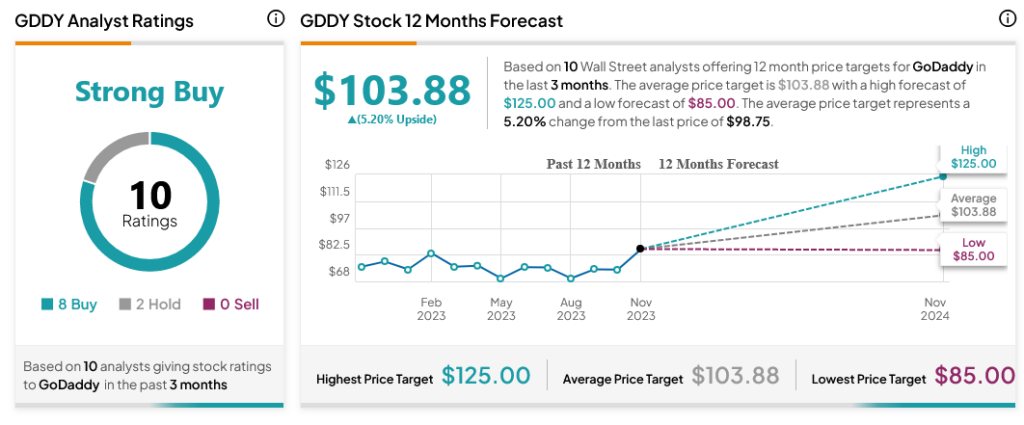

Turning to Wall Street, analysts have a Strong Buy consensus rating on GDDY stock based on eight Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 24.92% rally in its share price over the past year, the average GDDY price target of $103.88 per share implies 5.2% upside potential.