It’s never really a surprise to hear that investors really want to see the companies whose stocks they own do better overall. Improving fundamental financial figures is vital to getting the best return, and that’s just what one investor called for with domain name registrar GoDaddy (NASDAQ:GDDY). GoDaddy added slightly as activist investor Starboard Value called for the company to improve operations.

Starboard currently owns about 7.8% of GoDaddy, and it’s not exactly getting a lot out of that big bloc of stock. GoDaddy has reportedly rejected several requests to put Starboard members on GoDaddy’s board, reports note, and that hasn’t sat well with Starboard. Starboard further noted that GoDaddy has “…repeatedly missed its commitments and generated poor shareholder returns.” Starboard further took GoDaddy to task by pointing out the roughly 40% discount it’s trading at compared to other stocks in the sector.

All of that was bad enough, but then, Starboard dropped the bomb. It noted that GoDaddy needed a new, expanded set of goals. And if it couldn’t actually reach those goals, it should “…remain open-minded about alternative value-creation opportunities, which could improve a potential sale of the company.” Starboard called for “significant margin improvement” as well as cost-cutting measures. GoDaddy’s response, meanwhile, was somewhat underwhelming, noting that it “…value(s) their perspective and (we) look forward to continuing the dialogue.”

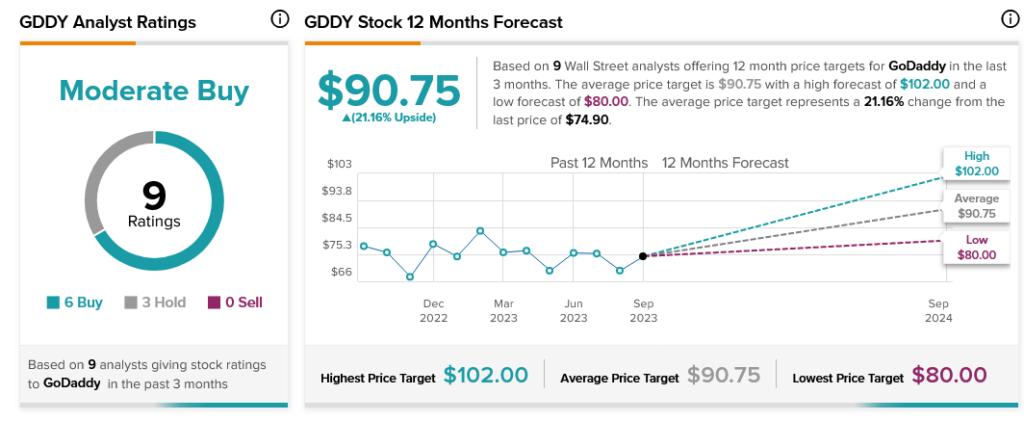

Meanwhile, analysts remain comparatively unfazed by these developments. With six Buy ratings and three Holds, analyst consensus calls GoDaddy stock a Moderate Buy. Further, with an average price target of $90.75, GoDaddy stock comes with an attractive 21.16% upside potential.