Meme stocks are making a comeback as retail traders chase volatility and social media buzz. A mix of short squeezes, social media hype, and market optimism has pushed several stocks into the spotlight. For investors, the key is timing and risk tolerance, as social buzz can fade as quickly as it spikes. Notably, GameStop (GME), AMC Entertainment (AMC), and Beyond Meat (BYND) are three meme stocks grabbing investor attention right now.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What are Meme Stocks?

Meme stocks are shares of companies that gain sudden popularity among retail investors, often fueled by social media platforms like Reddit, X, or TikTok. The buzz can send their prices soaring rapidly, often far beyond what fundamentals justify.

These stocks are highly volatile, driven more by hype, viral trends, and online sentiment than by traditional financial metrics.

Analyze and Compare Meme Stocks with TipRanks

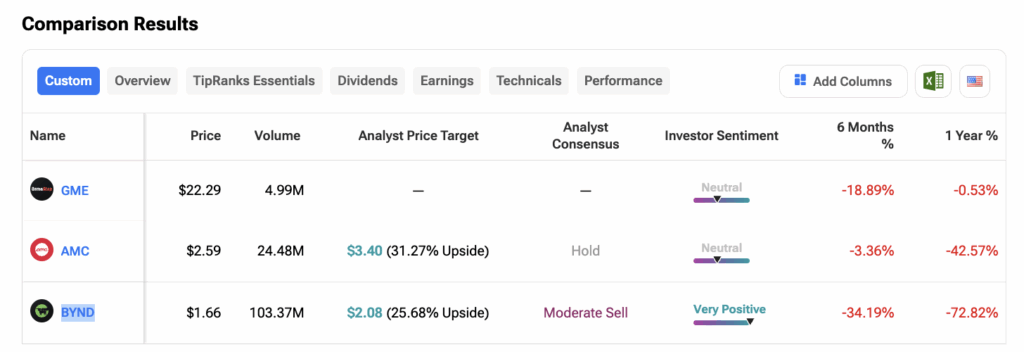

TipRanks offers powerful tools to help investors discover and monitor stock opportunities that fit with their goals. In this context, the Meme Stocks tool lets users compare up to ten trending meme stocks across key metrics like analyst ratings, price targets, investor sentiment, etc.

Let’s look at the details.

1. GameStop (GME) – The Original Meme Stock

GameStop is a video game and electronics retailer best known for its massive retail investor following. In early 2021, it became the face of the historic meme-stock short squeeze, soaring over 1,500% in weeks. The company continues to attract attention amid ongoing turnaround efforts and shifting strategies. Year-to-date, GME stock is down about 28%.

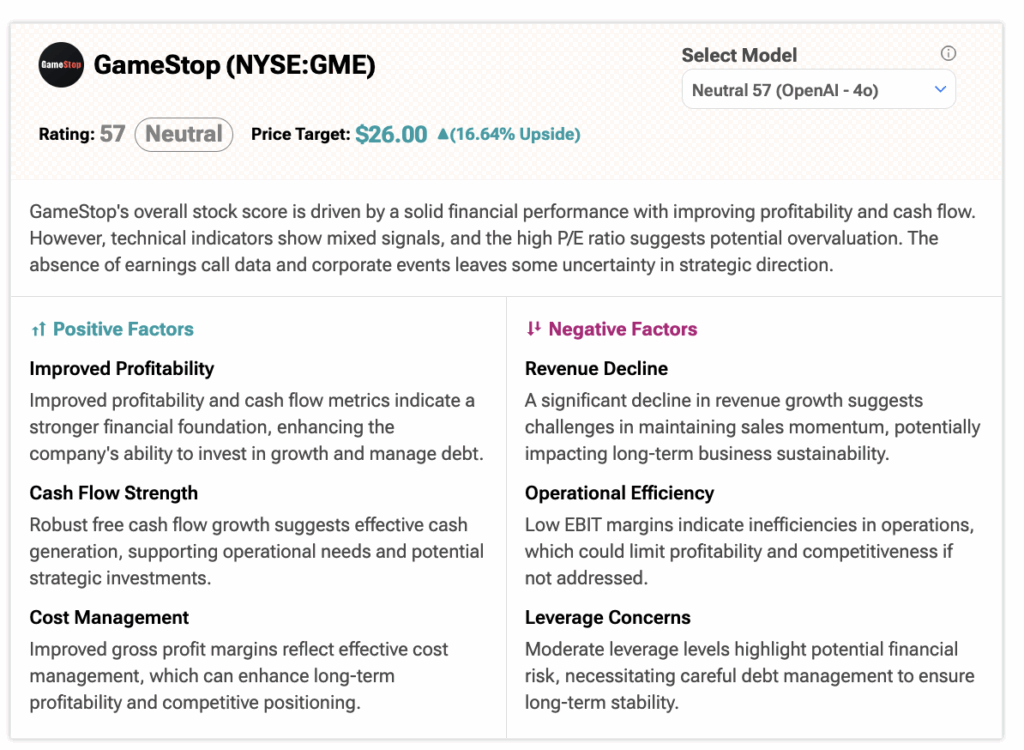

TipRanks currently shows no Wall Street analyst coverage for GME. However, TipRanks’ A.I.-based stock analysis (based on OpenAI) rates the stock as Neutral, with a price target of $26, implying a potential upside of over 16% from current levels.

2. AMC Entertainment (AMC) – Retail Hype Strikes Again

AMC Entertainment is the world’s largest movie theater chain and a favorite among retail investors. The company remains in focus as it works to manage debt, boost attendance, and capitalize on box office recoveries and streaming partnerships. Year-to-date, AMC stock has declined almost 35%.

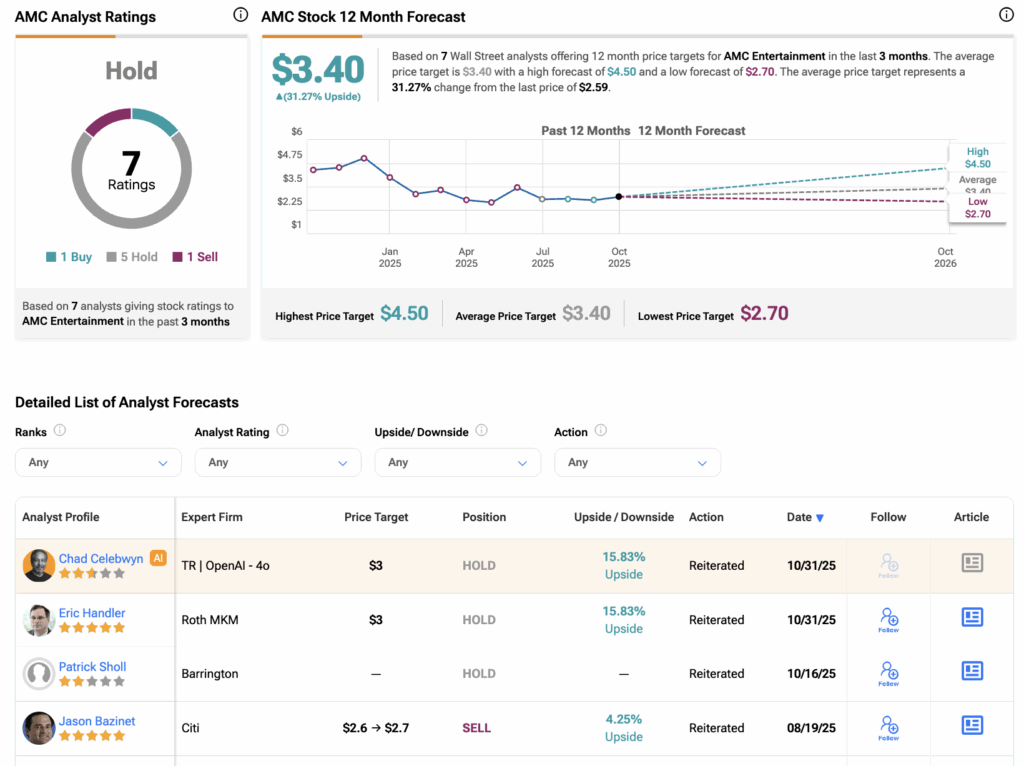

Turning to Wall Street, analysts have a Hold consensus rating on AMC stock based on one Buy, five Holds, and one Sell assigned in the past three months. Furthermore, the average AMC price target of $3.40 per share implies 31.0% upside potential.

3. Beyond Meat (BYND) — The Next Great Meme Stock

Beyond Meat is a plant-based protein company known for its meat alternatives like burgers, sausages, and chicken products. The stock surged over 1,000% in just a few sessions in October. The rally was driven less by business fundamentals and more by chatter on social media suggesting Beyond Meat’s short interest was unusually high. Retail traders on Reddit (RDDT) and X quickly rallied around it, calling it the next GameStop.

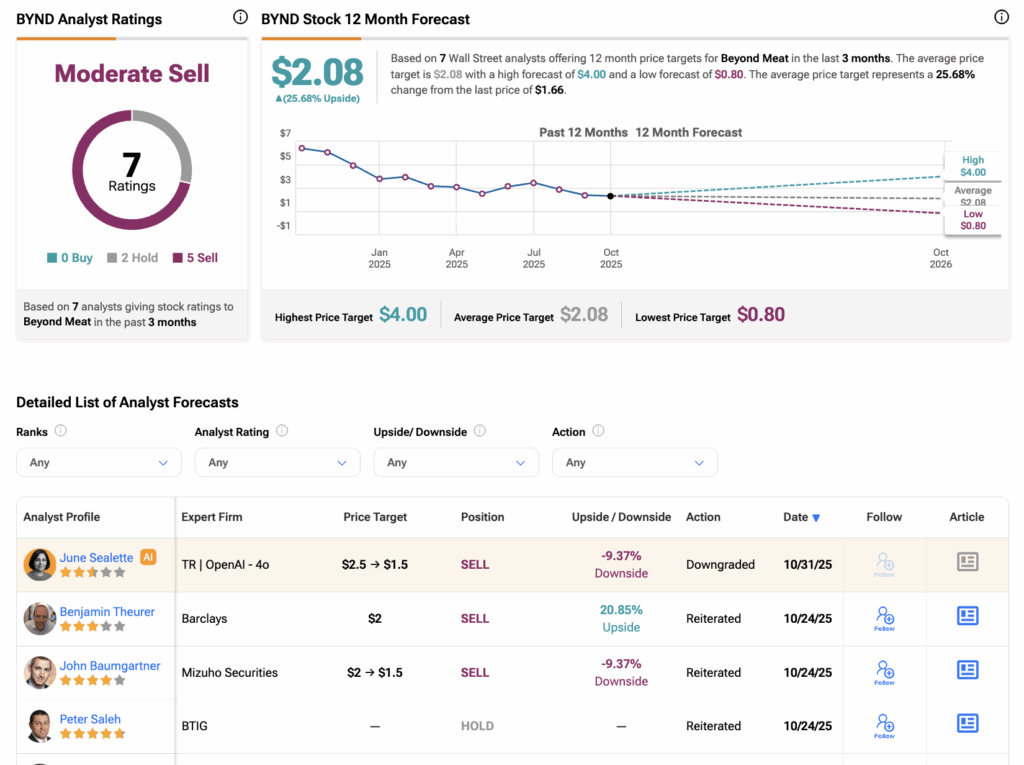

Turning to Wall Street, analysts have a Moderate Sell consensus rating on BYND stock based on five Sells and two Holds assigned in the past three months. Furthermore, the average Beyond Meat stock price target of $2.08 per share implies an upside of over 25% from the current level.