While most are paying attention to the AI arms race in terms of tech these days, the electric vehicle stakes are also heating up. In fact, GM (NYSE:GM) is taking the fight directly to Tesla (NASDAQ:TSLA) by seeking to do something that, to this day, eludes Tesla. GM is out to produce a self-driving car that can actually drive itself and may have done it with its new “Ultra Cruise” system.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ultra Cruise seeks to handle a car without risks of sudden odd behavior like stopping in the middle of a freeway or a slew of other possible disasters. What’s better is that GM’s system is pretty much ready for prime time—it’ll be available as part of the 2024 Cadillac Celestiq line—but it will also be ready to handle about 95% of the various scenarios it might encounter. Better yet, it even knows when to ask for help; the system will actually ask the driver to take over for some maneuvers.

GM’s system doesn’t just tap out in the event of tough driving—like a complex intersection or in roundabouts—it also tends to stop in very close quarters. Ultra Cruise will get you to a parking lot, for example, but you’ll have to take over to find a space. Yet given that GM plans to put this on a car that costs $300,000, it may not see very many takers early on.

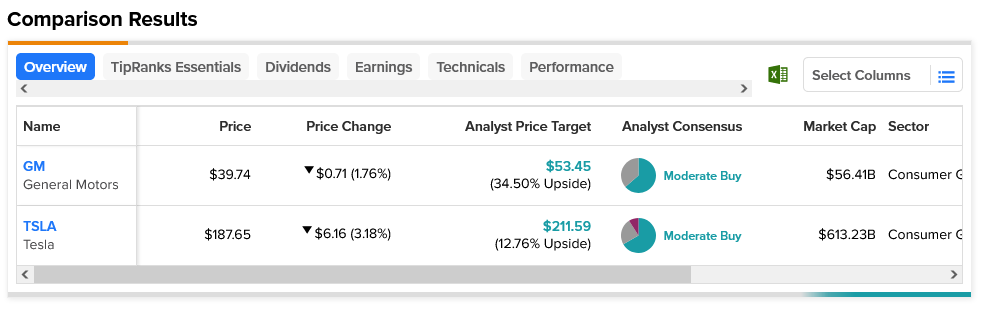

Overall, both Tesla and GM are considered Moderate Buys by analysts. However, GM has nearly three times the upside potential that Tesla has. GM’s average price target of $53.45 gives it a 34.5% upside potential. Meanwhile, Tesla’s $211.59 average price target gives it just 12.76% upside potential.