While the news about General Motors (NYSE:GM) and its self-driving taxi unit might have been a bit of a problem, there are signs it’s turning that around. Those signs were built on with Thursday afternoon’s trading performance, as GM was up nearly 5% in the session with news of a new electric Cadillac.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

GM has brought out some all-electric SUVs previously, but the Cadillac Vistiq will prove a cut above, as pretty much anything with the Cadillac name attached to it would. It’s a replacement for the XT6, which was a gas-powered SUV, and will offer third-row seating to ensure plenty of room in the ride. The Vistiq will be the fifth electric vehicle from GM, and is meant to fit between the Lyriq electric vehicle and the upcoming Escalade IQ, another all-electric SUV with Cadillac branding. GM kept mum on several key details for now, including pricing, availability, and when it will actually release. However, it’s expected sometime in 2025 with a 2026 model year branding.

Facing Down Controversy

The Vistiq’s appearance comes at a good time for GM. Not only is it facing down issues in its self-driving taxi operations—to the point where the government’s getting involved and several executives lost their jobs as a result—but it’s also drawing fire for its recent move with CarPlay and Android Auto. GM decided to pull the plug on these “infotainment” systems, citing plans to offer a more “integrated” system rather than a third-party system that’s dependent on phone casting as these two are. Others of a more cynical bent have suggested that GM loses access to a user’s data under such a system, and wants that valuable data back in its own control. Either way, however, the move has proven a sore spot among consumers, who want the systems back in play.

Is GM a Good Stock to Buy?

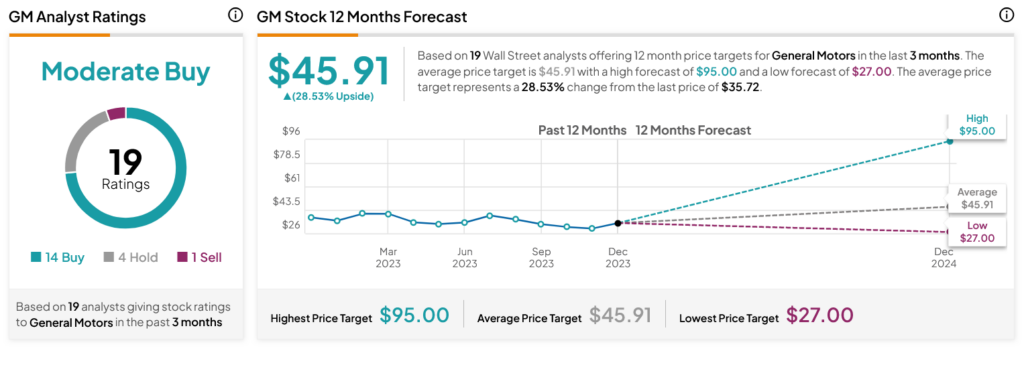

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GM stock based on 14 Buys, four Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 4.41% loss in its share price over the past year, the average GM price target of $45.91 per share implies 28.53% upside potential.