General Motors (NYSE:GM), Honda (NYSE:HMC), and Cruise (GM’s subsidiary developing autonomous vehicle technology) plan to introduce Robotaxi service in Japan. The automotive companies established a joint venture to provide driverless ride-hail service in Japan starting in early 2026.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

General Motors CEO Mary Barra stated, “GM has always been invested in defining the future of transportation, and that’s more true today than ever.” Further, General Motors will produce approximately 500 autonomous vehicles to launch this service.

The three companies plan to start the preliminary testing of this service next year, subject to government approvals. Moreover, the commercial launch is set to kick off in early 2026 in central Tokyo. Following the commercialization, the companies plan to extend and broaden the service to other regions beyond central Tokyo.

Earlier, General Motors postponed the opening of an EV (Electric Vehicle) truck manufacturing plant in Michigan. The move is part of the company’s strategy to manage capital better and improve its truck margins. With this backdrop, let’s look at analysts’ recommendations for General Motors stock.

Is GM Stock Expected to Go Up?

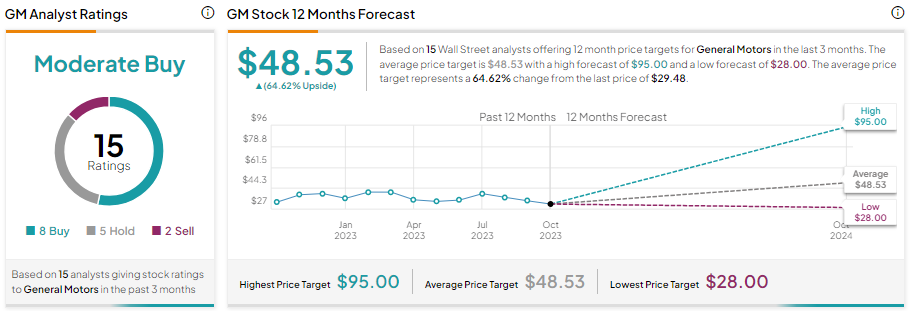

GM stock has underperformed the broader markets so far this year and is trading in the red. Concerns around costs, the ongoing UAW strike, and weakening EV demand have taken a toll on General Motors stock. However, analysts see significant upside potential over the next 12 months.

General Motors stock has received eight Buy, five Hold, and two Sell recommendations for a Moderate Buy consensus rating. Further, the average GM stock price target of $48.53 implies 64.62% upside potential from current levels.