The demand for electric vehicles (EVs) in the U.S. is witnessing a slump, pushing back South Korean battery makers from making huge investments. South Korean battery makers, including LG Energy Solutions (LGES) and SK On, are scaling back investments in North America. This is likely to hurt EV production, as the supply of batteries, a crucial component of EVs, will take a hit. If EV battery makers take a step back, it is expected to hamper the electrification ambitions of automakers such as General Motors (NYSE:GM) and Ford (NYSE:F). More so, because both of these legacy automakers have joint ventures with these battery makers to produce EV batteries.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

EV Battery Makers Curtail Investments

LGES, one of the world’s largest battery makers, is cutting roughly 14% of its staff in the Holland, Michigan, plant. LGES has a joint venture with General Motors, Honda (NYSE:HMC), and Hyundai (OTCMKTS:HYMTF).

Meanwhile, SK Battery America is temporarily cutting production at its Georgia plant and has put some production employees on unpaid leave, citing the slow growth of EVs. The company has a joint venture with Ford. SK and Ford have also delayed the launch of a second battery plant in Kentucky, which was set to begin operations in 2026.

The news comes as President Joe Biden pushes for the electrification of the American auto industry. Following the U.S. Inflation Reduction Act (IRA) announcement and the $7,500 tax credits for buying EVs, major battery makers rushed to invest billions of dollars in American EV battery plants. However, battery makers are saying that automakers are not ramping up EV production as expected, forcing them to reconsider investments.

Which is Better, General Motors or Ford?

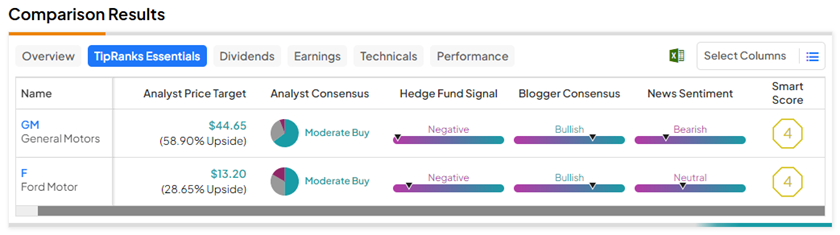

General Motors and Ford have both announced the scaling back of EV ambitions and withdrawn some of their targets owing to slow EV growth. Moreover, the recent labor strikes and the new labor contracts are expected to put pressure on their margins. With this background in mind, let’s look at how both stocks perform based on the TipRanks Stock Comparison Tool.