Semiconductor major GlobalFoundries (NASDAQ:GFS) is planning to invest nearly $8 billion in its chip manufacturing facility in Germany. The investment is aimed at doubling output at the plant by the end of 2030.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Further, GFS is also looking to receive government support for the plant. Taiwan Semiconductor (NYSE:TSM), its competitor, is also looking to land government support for its envisaged plant in Germany. Reportedly, TSM will receive nearly $5.5 billion in government aid for its German facility.

Earlier this month, GFS opened a $4 billion facility in Singapore in anticipation of rising chip demand. GFS is the third-biggest chipmaker by top-line globally, and the company expects demand for its chips to double over the next 10 years. While Singapore remains a major chip production hub, Europe is also seeing a steady stream of new investments in chip manufacturing. This dynamic is a result of the world slowly weaning itself away from its dependence on China for advanced technological production.

What Is the Target Price for GFS Stock?

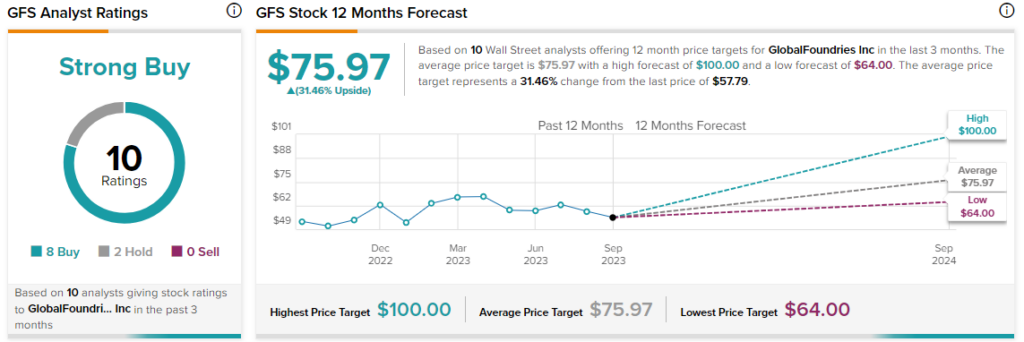

Overall, the Street has a consensus price target of $75.97 on GFS, alongside a Strong Buy consensus rating. This implies a hefty 31.5% potential upside in the stock.

Read full Disclosure