Payments service Global Payments (NYSE:GPN) delivered solid numbers for its third quarter, and also managed to offer up a look at the full-year’s results that caught investors’ attention. Not much attention, sadly, as Global Payments shares were only up fractionally in Tuesday morning’s trading. But a win is still a win, and gain is still gain.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Global Payments revealed that it upgraded its full-year forecast for earnings per share (EPS) to between $10.39 and $10.45 per share. Analysts, meanwhile, were looking for $10.40, so it’s not surprising that the gains were limited in light of the fact that Global Payments upgraded its forecast to match that of analysts. However, this gain also reflects a growth rate between 11% and 12% against 2022’s figures, which is an achievement on its own. Revenue, meanwhile, didn’t change much. It remains projected between $8.66 billion and $8.74 billion, which is about what analysts had in mind projecting $8.68 billion.

Now, how does Global Payments get there from here? It’s got a few ideas in place. With the number of banks considering partnerships with financial technology (fintech) operations as “important” on the rise, that’s where operations like Global Payments can step in to provide support. Banks have long had a difficult time with modifying their technology; so much of their success depends on a perception of security in a largely unsafe world. Making changes too rapidly can spoil that image and hurt business. But banks must adapt to changing times, and the rapid pace of technological change made partnerships necessary. And with that, Global Payments can offer its services on a wider basis and, in turn, make more revenue while improving earnings.

Is Global Payments a Good Stock to Buy?

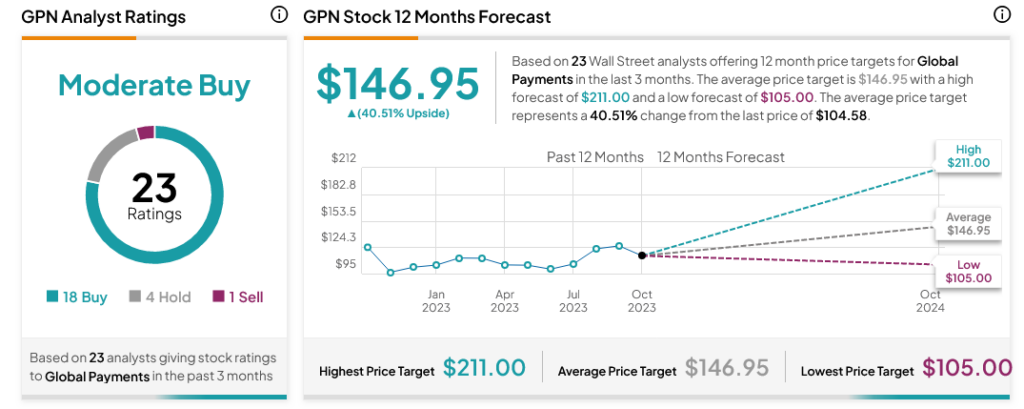

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GPN stock based on 18 Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average GPN price target of $146.95 per share implies 40.51% upside potential.