DAX-listed Zalando SE (DE:ZAL) received Buy ratings from two analysts yesterday, suggesting more upside potential in the share price. Analysts are looking forward to improved performance in the second half of 2023, thanks to the company’s effective cost management strategies. The analysts anticipate that the company’s profits will exceed initial expectations. On TipRanks, the stock has received a Moderate Buy rating based on a total of 15 recommendations.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Zalando is a German retail company that specializes in clothing, footwear, and other lifestyle products. The company serves its customers in around 25 countries in Europe through its online platform.

The shares have not fared well in 2023 and have experienced a 24% decline YTD. Over the span of three years, the stock has witnessed a decline exceeding 62% in the long run.

Q2 Earnings and Updated Guidance

Earlier in August, the company announced its Q2 2023 earnings with better numbers. The revenues were down by 2.5% to €2.56 billion, driven by lower volumes as more customers preferred the in-store experience. Despite lower revenues, the company’s earnings before tax and interest in Q2 increased by a huge 87% to €144.8 million as compared to the same period last year. The net profit also grew to €56.6 million from €14 million, mainly due to its effective cost management.

For the full year 2023, adjusted earnings are now anticipated to fall between €300 million and €350 million, deviating from the earlier guidance of €280 million to €350 million. Zalando also expects its gross merchandise volumes to grow by 1% to 7%.

Recent Ratings

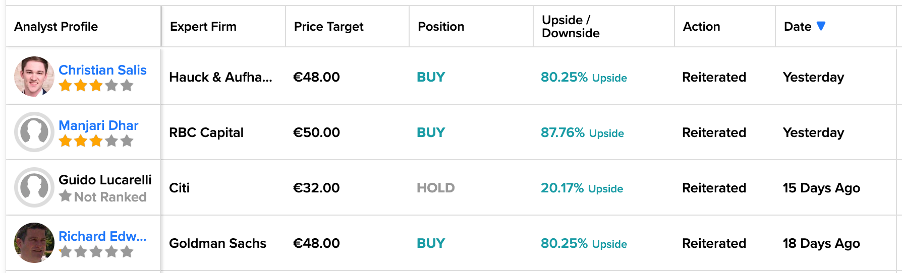

Following the positive set of results, analysts have expressed their favorable outlook on the share price while maintaining their ratings. Analysts believe the current share price doesn’t fully capture its promising future prospects, suggesting this is the right opportunity to enter the stock.

On the flip side, the evidently high beta value of 2.04 underscores the considerable volatility of the share price. The company’s stock has experienced various fluctuations in trading in the last month, reaching a high point of €31.3 and a low point of €26.5.

Yesterday, analyst Christian Salis from Hauck & Aufhaeuser confirmed his Buy rating on the stock, predicting a solid growth rate of 80% in the share price.

Likewise, RBC Capital analyst Manjari Dhar also recommended buying the stock yesterday. Her price target of €50 indicates a promising potential upside of 88.1% in the share price.

Zalando Share Price Target

As per the consensus rating on TipRanks, ZAL stock received a Moderate Buy rating supported by a combined count of 15 recommendations. It includes nine Buy, five Hold, and one sell ratings. The average price forecast stands at €38.5, signifying a substantial potential upside of 44.8% in the share price.

Conclusion

The recently confirmed Buy ratings for the stock, forecasting a substantial increase in the share price, unequivocally demonstrate analysts’ confidence in both the company’s future performance and the stock itself.