ASX-listed Woolworths Group Ltd. (AU:WOW) warned this morning that its first-half results for Fiscal 2024 will be hit by extraordinary charges. The charges relate to the poor performance of the company’s New Zealand (NZ) business and a change in the accounting treatment of its equity investment in Endeavour Group (AU:EDV). WOW shares dropped over 1.2% in early morning trading on the news.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Woolworths Group is one of Australia’s largest grocery chains. It operates supermarket stores in Australia and New Zealand as well as a discount department store called Big W. WOW shares have gained over 4% in the past year.

WOW’s First-Half Performance

Woolworths’ New Zealand business has witnessed sluggish demand and delayed results due to the company’s transformation efforts. Owing to this, Woolworths, also called Woolies, expects a non-cash impairment charge of NZ$1.6 billion in the first half results. The impairment will be recorded as a write-down of its goodwill balance of NZ$2.3 billion. This charge will lead to Woolies reporting an H1 FY24 EBIT (earnings before interest and tax) of NZ$71 million, 42% lower than the prior year period. WOW has also borne transformational charges of NZ$13 million, which will be reflected in the results.

Having said that, WOW is expected to report modest growth in its group EBIT, thanks to the resilient performances of Australia’s supermarket and food distribution businesses. For H1 FY24, Woolworths expects EBIT in the range of AU$1.68 billion to AU$1.70 billion, up 2.8% to 3.8% year-over-year. Woolworths is confident that the challenges in New Zealand are temporary and its transformation efforts will show results soon.

Furthermore, Woolworths implemented a change in its accounting treatment for the 9.1% stake in alcoholic beverage maker Endeavour Group. Following a review of its stake, Woolworths has realized that it no longer has a controlling influence over Endeavour Group. Hence, WOW will no longer report EDV stake as an equity investment but as a financial asset measured at fair value. Accordingly, WOW will include a loss of AU$209 million in the group’s bottom line, based on EDV’s closing share price on December 31, 2023. Woolworths will provide further details during its H1 FY24 results scheduled for February 21, 2024.

Is WOW a Good Investment?

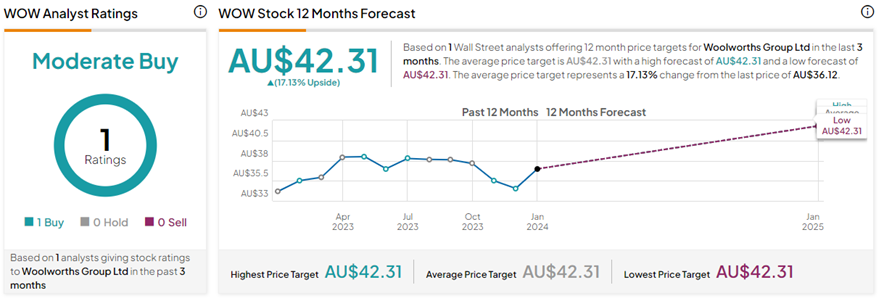

Based on just one Buy rating received during the past three months, WOW stock has a Moderate Buy consensus rating. On TipRanks, the Woolworths Group share price target of AU$42.31 implies 17.1% upside potential from current levels.