Australian energy giants Woodside Energy (AU:WDS) and Santos (AU:STO) are engaged in preliminary discussions for a potential merger valued at A$80 billion. The details of the deal remain unknown at the moment as the talks are still in the early stages and the agreement has not yet been finalized. The two companies confirmed the talks but have cautioned that they could walk away without coming to a concluding deal. STO stock is up 6% on the news today, while WDS shares are down 0.53%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Here’s Why WDS and STO Plan to Merge

Woodside Energy is Australia’s largest oil and gas producer with the potential to become the most liquefied natural gas (LNG)-leveraged company globally. Just last year, WDS completed its merger with BHP’s oil and gas business, which nearly doubled its business scale.

Santos, on the other hand, is a comparatively smaller oil and gas company owning LNG, pipeline gas, and oil assets. In 2021, Santos merged with Oil Search, Papua New Guinea’s largest oil producer. At the recent event, Santos CEO Kevin Gallagher noted that the company is reviewing strategic alternatives to increase shareholder value, including splitting off its LNG business.

The merger talks have been initiated as both companies face similar challenges, such as production snarls, growing capital expenditures, and regulatory issues with growth projects.

The merger of Woodside and Santos would effectively mean the combination of four energy majors, making a behemoth oil and gas company in Australia. The combined company would aim to become one of the world’s largest LNG exporters. As countries turn toward renewable resources and greener energy alternatives, LNG seems like the current viable alternative to coal-generated power. The merger would mark the year’s largest deal amid the growing consolidation of the oil and gas sector worldwide.

Is Woodside a Good Investment?

Following the merger news, Citi analyst James Byrne reiterated a Sell rating on WDS stock with a price target of A$26.50 (11.1% downside potential).

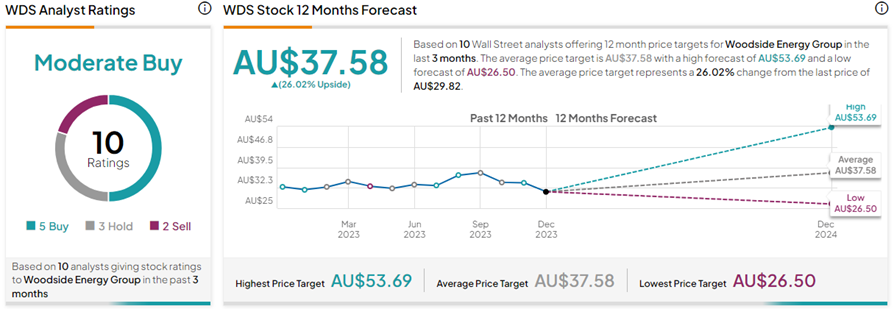

On TipRanks, WDS stock has a Moderate Buy consensus rating based on five Buys, three Holds, and two Sell ratings. The Woodside Energy share price forecast of A$37.58 implies 26% upside potential from current levels. Year-to-date, WDS shares have lost 7.5%.

What is the Target Price for Santos?

Analyst Byrne maintained his Buy rating on STO stock with a price target of A$8.25 (13.7% upside potential).

Overall, with ten Buys and two Hold ratings, STO stock has a Strong Buy consensus rating on TipRanks. The Santos Ltd share price forecast of A$8.93 implies 23.3% upside potential from current levels. Year-to-date, STO shares have gained 7.8%.