The shares of the UK-based John Wood Group PLC (GB:WG) gained over 4% on Tuesday after the company raised its full-year guidance for 2023. Despite posting a decline in its operating profits, the company increased its revenue and earnings forecast for the full year. This was mainly attributed to new contract wins and a strong order book.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Wood Group is an engineering company that provides solutions under three business segments: consulting, projects, and operations. The company has a presence in more than 60 countries and caters to the energy and material sectors.

First-half Numbers and Strong Guidance

The company posted a growth rate of 16.5% on its revenue of $3 billion in its first-half earnings, driven by growth across all business units. The adjusted EBITDA also grew by 9% to $202 million. The operating profit went down by 26% to $23 million, hit by $31 million of exceptional items. It included costs related to the takeover bids from Apollo Management, which were later scrapped, and impairment costs for closed-down businesses in 2022.

The highlight of the results was the company’s strong order book, which stood at $6 billion as of June 2023. It was also up by 5% as compared to the value in December 2022. The company also won some significant contracts during this period from names like Shell UK (GB:SHEL) and GlaxoSmithKline (GB:GSK).

Looking ahead, the company is now anticipating annual revenues of approximately $6 billion, an increase from the initial forecast of $5.7 billion. Moreover, the adjusted EBITDA is expected to surpass its prior estimates and align with the company’s medium-term objective of achieving mid-high single-digit growth.

What is the Stock Price Forecast for John Wood?

The shares traded up by 4.73% yesterday after the results announcement. The shares are still recovering after their great fall in May 2023. The shares experienced their biggest single-day fall in May after the U.S.-based private equity company Apollo Global Management decided not to proceed with the acquisition of the company. YTD, the stock has gained 9.7%.

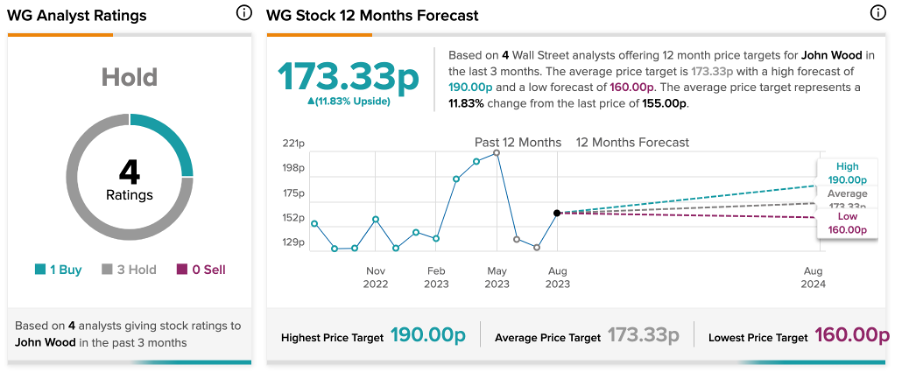

Analysts have mixed views on WG stock, which is evident in its Hold rating on TipRanks. The consensus is based on three Hold versus one Buy recommendations. The stock presents investors with a potential upside of 11.8%, owing to the average price target of 173.3p.

These ratings were assigned well in advance of the earnings announcement, and it is anticipated that analysts will make favorable adjustments to them.