Shares of Wizz Air Holdings plc (GB:WIZZ) are heading south after swinging to a loss of €105.4 million in the third quarter of Fiscal 2024 from a profit of €33.5 million in the prior-year quarter. Results reflected the impact of the Israel-Hamas conflict and engine inspections that hit a part of the airline’s fleet. WIZZ shares plunged over 8% in early morning trade but have recovered since and are down 4.5% at the time of writing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Wizz Air Holdings is a British low-cost passenger air carrier with operations in central and eastern Europe. The air carrier witnessed record traffic in the December quarter, carrying 15.1 million passengers, up 22% year-over-year. Also, the load factor improved marginally to 87.6%.

More About Wizz Air’s Q3 FY24 Results

Wizz Air’s Q3 revenues grew 16.8% year-over-year to €1.06 billion thanks to a robust pick-up in travel demand. The air carrier’s load factor was marginally affected by the ongoing Israel-Hamas war. Wizz had to cancel 6% of its planned capacity in Q3 due to the war but plans to restart flying to Israel through alternate routes on March 1, 2024.

It is worth noting that the air carrier reported an underlying EBITDA (earnings before interest, tax, depreciation, and amortization) of €18.7 million compared to an EBITDA loss of £2.8 million in the prior-year quarter. However, higher expenses led to an operating loss in the quarter.

Meanwhile, management is trying to address the grounding of aircraft due to the geared turbofan (GTF) engine issues. As of January 24, 33 jets with GTF issues were grounded. The company is receiving compensation from the original equipment manufacturer (OEM), Pratt & Whitney, for the same.

Is Wizz Air Stock a Buy?

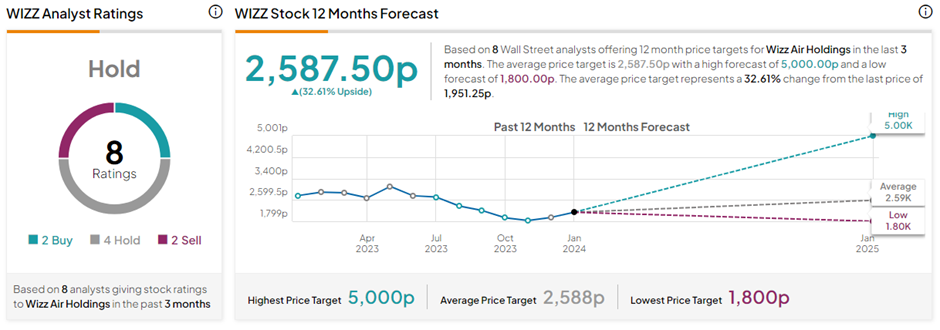

Recently, Deutsche Bank analyst Jaime Rowbotham lifted the price target on WIZZ stock to 1,800p from 1,550p but maintained a Sell rating.

On TipRanks, WIZZ stock has a Hold consensus rating based on two Buys, four Holds, and two Sell ratings. The Wizz Air Holdings share price target of 2,587.50p implies 32.6% upside potential from current levels.