British aerospace and defence company Rolls Royce (GB:RR) has had a commendable year, with share price appreciating over 220% in 2023. The plane engine maker has many things going for it, particularly a solid turnaround strategy, increased demand for flying, strong government defence spending, and a stronger U.S. dollar. Plus, the FTSE 100-listed company is on track to achieve a higher investment grade rating by agencies. All these factors make for a winning combination for improved share price performance in 2024.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Factors Working in Favor of RR’s Recovery

Rolls-Royce’s CEO Tufan Erginbilgic, who took the helm exactly a year ago, has outlined a solid turnaround strategy for the company, including cutting down costs and streamlining operations. The CEO also announced new targets in November 2023, including meeting operating profits of up to £2.8 billion by 2027. Also, the company aims to improve operating margins to 13% to 15%.

A majority of Rolls-Royce’s revenues come from long-term service agreements with commercial airlines. The company needs to ensure that its engines have higher “time on wing” to reduce maintenance costs and meet its long-term targets. Rolls-Royce is also benefitting from the increased demand for air travel as this also increases the demand for widebody aircraft that it manufactures.

On December 13, S&P Global upgraded its issuer rating on RR to BB+ from BB, citing a positive outlook. The agency is optimistic about the engineer’s continuous positive free cash flow generation in 2024 and steadily improving operating profit and EBITDA (earnings before interest tax depreciation and amortization) margins. Should the momentum continue, S&P is expected to upgrade its rating on the stock further.

Is Rolls-Royce a Good Stock?

Analysts are bullish about Rolls-Royce stock thanks to its improving performance. Last week, Jefferies analyst Chloe Lemaire reiterated a Buy rating on RR stock with a price target of 310.00p (3.4% upside).

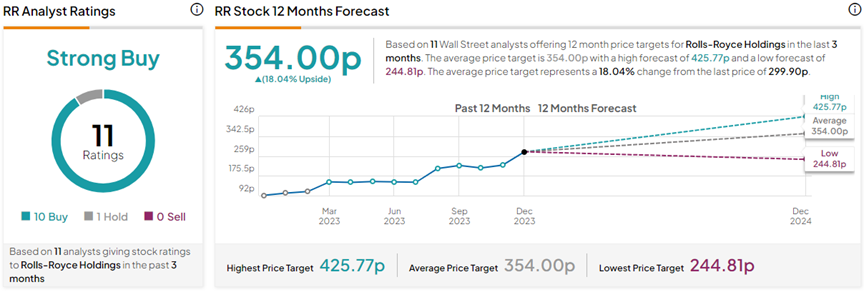

On TipRanks, RR stock has a Strong Buy consensus rating based on ten Buys and one Hold rating. The Rolls-Royce share price target of 354.00p implies 18% upside potential from current levels.

Closing Thoughts

Rolls-Royce’s success story is in full-throttle mode as several tailwinds work in its favor. The company’s efforts to improve its operating and financial performance are proving worthy. Backed by a positive outlook, RR stock could well be on its way to another strong year as per analysts.