The Hong Kong-listed shares of China-based Alibaba Group Holding Limited (HK:9988) have traded down by almost 15% in 2023. The stock has lost around 60% of its value in the last five years. Nonetheless, analysts are bullish on Alibaba stock and predict a solid upside in the share price. Moreover, the stock scores a “Perfect 10” on the TipRanks Smart Score Tool, indicating its potential to outperform the market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Alibaba is a Chinese technology company widely known for its online marketplace.

The Bullish Case

Despite being a major player in the e-commerce industry, BABA shares have failed to generate investor wealth since their Hong Kong listing. The company has faced various regulatory and competitive pressures, resulting in a decline in its share price. Additionally, the weakness in the Chinese economy also impacted investor sentiment.

Analysts, on the other hand, have not lost hope on the tech giant and have maintained their Buy ratings. Analysts are mainly bullish on the stock due to the company’s dominance in Cloud and e-commerce businesses. Also, the company streamlined its operations and divided the business into six business units last year. This move intended to resolve some of the company’s regulatory issues and to pursue separate IPOs for the six units in the future.

Last week, analyst Thomas Chong from Jefferies reiterated a Buy rating on Alibaba stock, predicting a huge upside of 85% in the share price.

Prior to that, J.P. Morgan analyst Alex Yao also confirmed a Buy rating on the stock, forecasting 59% growth.

Is Alibaba a Good Stock to Buy Now?

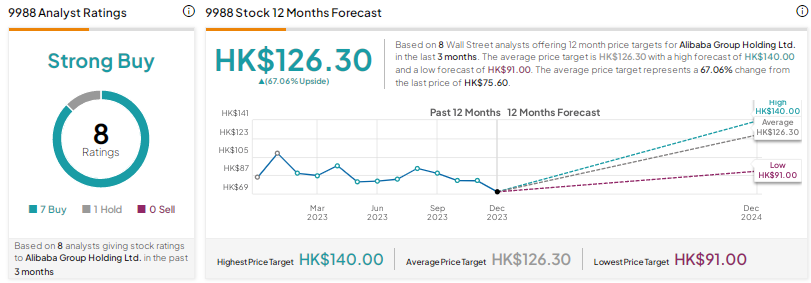

On TipRanks, 9988 stock has received a Strong Buy consensus rating based on seven Buys and one Hold recommendation. The Alibaba share price target is HK$126.30, which reflects an upside potential of 67% on the current trading price.